ERShares

Funds

Why Entrepreneurs?

We believe entrepreneurial leaders create fundamental value. They see far horizons and are resilient in tough times. Their organizations keep costs lean, debt levels manageable and expansion projects within reach. Historically entrepreneurial companies have outperformed their competition. Our research asserts that entrepreneurially run companies achieve higher long run growth rates. They focus on sustainable organic growth and operational efficiency.

These entrepreneurs have economic and non economic incentive to create wealth for themselves and all other stakeholders. They hold a long term vision that far exceeds typical leaders of major corporations.

Entrepreneur Factor®

Entrepreneur Factor® (EF) incorporates a bottom-up investment orientation that stands above other investment factors such as: momentum, sector, growth, value, leverage, market cap (size) and geographic orientation. Moreover, with the aid of Thematic Research, ERShares incorporates a macro-economic, top-down approach that integrates changing investment flows, innovation entry points, sector growth and other characteristics into a dynamic, global perspective model.

ERShares EF delivers strong performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics. ERShares’ research, developed at Harvard University, has been widely disseminated in leading investment journals around the world and has surpassed independent peer review. This proprietary research, and ERShares’ long-standing position as one of the first (if not the first) thematic investment managers (established in 2005), enables them to maintain their leadership status within the community of disruptive, innovative and Entrepreneurial investment strategies.

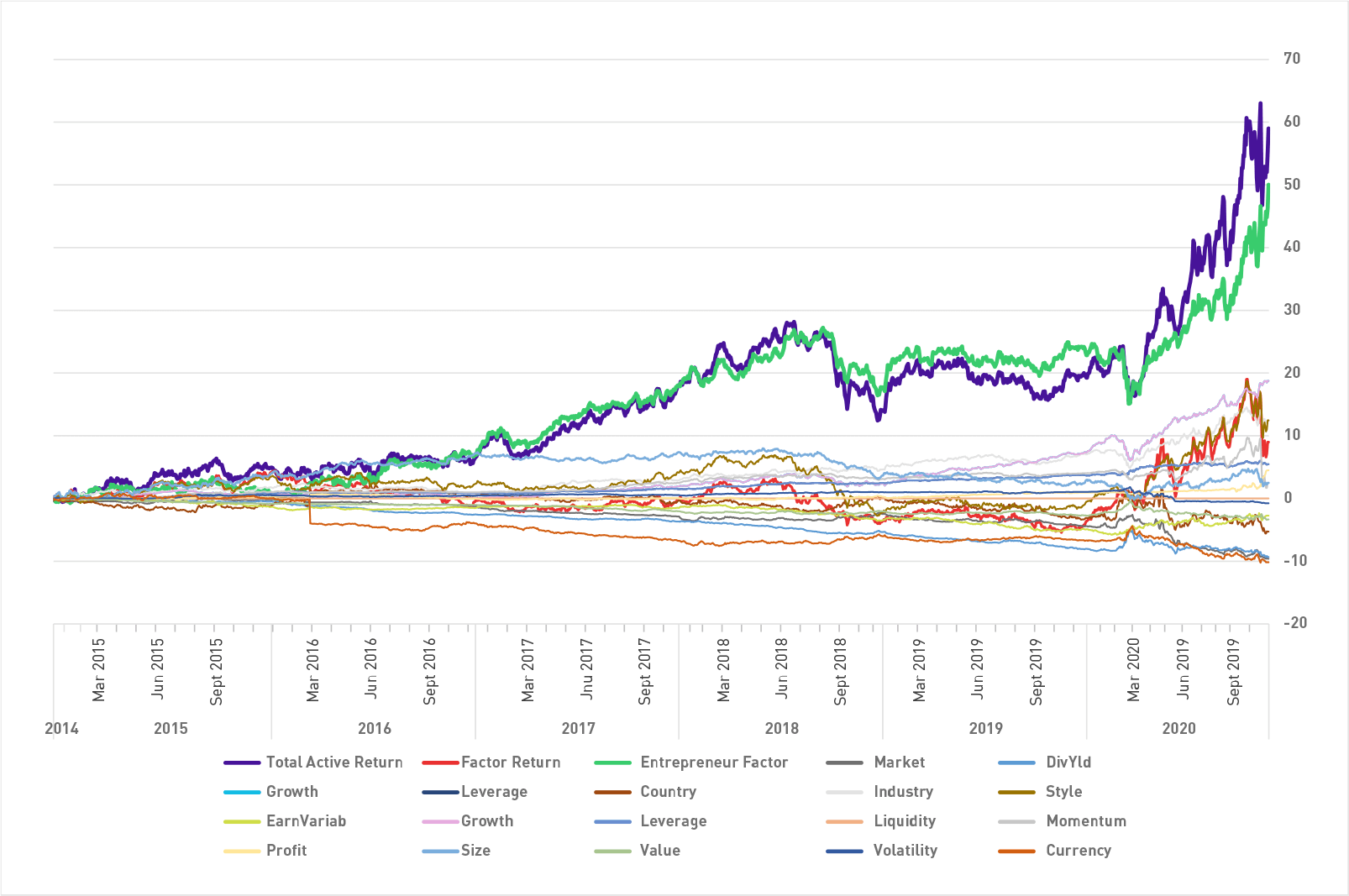

EF Dominance vs all other Factors

Click to view chart fullscreen

Entrepreneur Factor® Explained

The Entrepreneur Factor® (EF) has been developed and statistically verified through a complex, data-intensive analysis available through a professional application on Bloomberg terminals. We include a representative list of the most widely applied Factors as well as the Entrepreneur Factor® as computed with our ERShares Global Entrepreneurs Mutual Fund (ENTIX). We compare it to its MSCI Global benchmark. There are many lines shown in the chart, but the most crucial lines include: Total Active Return, Entrepreneur Factor® and Factor Return. The Total Active Return represents the total excess return that the ERShares Global Entrepreneurs Mutual Fund provides above its assigned benchmark. This line theoretically should approach 0% if the fund does not provide additional value to the investor. If the line is above 0% (as shown in the graph) then it provides excess, risk-adjusted return. This is something generally pursued by most investors. But investors will want to know what is driving the excess return? The most common traits include criteria such as: Growth stocks, Value stocks, Momentum stocks, Highly Leveraged companies, Large Cap stocks, Technology stocks, HealthCare stocks, Industry, Country, Currency, etc. These categories include Sector, Style and Country traits known as “Factors”. Bloomberg identifies more than 25 Factors and we include them all to help explain the Total Active, or excess risk-adjusted return. Typically, the common factors all aggregated together are referred to as the “Factor Return” and will comprise most of the Total Active return. However, in the case above, the selection effect, or “Entrepreneurial Factor” is almost the same as the Total Active return. In fact, during this time period of analysis, the “Entrepreneur Factor®” represents approximately 85% of the Total Active return, leaving approximately 15% for all of the other Factors combined. It’s important to note that the EF does not work in this manner during all periods, and these excess, risk-adjusted returns from the past may not be representative of the future. However, this graph does demonstrate the major tenet of our investment thesis: over an extended period of time we maintain that Entrepreneurs will outperform Non Entrepreneurs around the world. This EF exhibit and explanation help provide support for our bold, investment statement, and why we believe ERShares provides strong value to investors.