ERShares

Funds

Mid-Cap Strategy

Why invest in Mid-Cap Strategy?

Mid Cap Entrepreneur strategy works best for innovative, disruptive companies that have passed the proof of concept phase and are now entering the explosive market penetration and high growth phase. Traditionally, some of the best performing entrepreneurial stocks have entered and successfully exited this category within a short period of time.

Any company that harbors hope of becoming the next Amazon or Tesla needs to, at some point, pass through the mid-cap stage. Some of the most exciting growth stories exist with companies currently below $10B in market cap, that hold great promise and appeal for something much larger. Midcaps represent the early potential that many great companies possess.

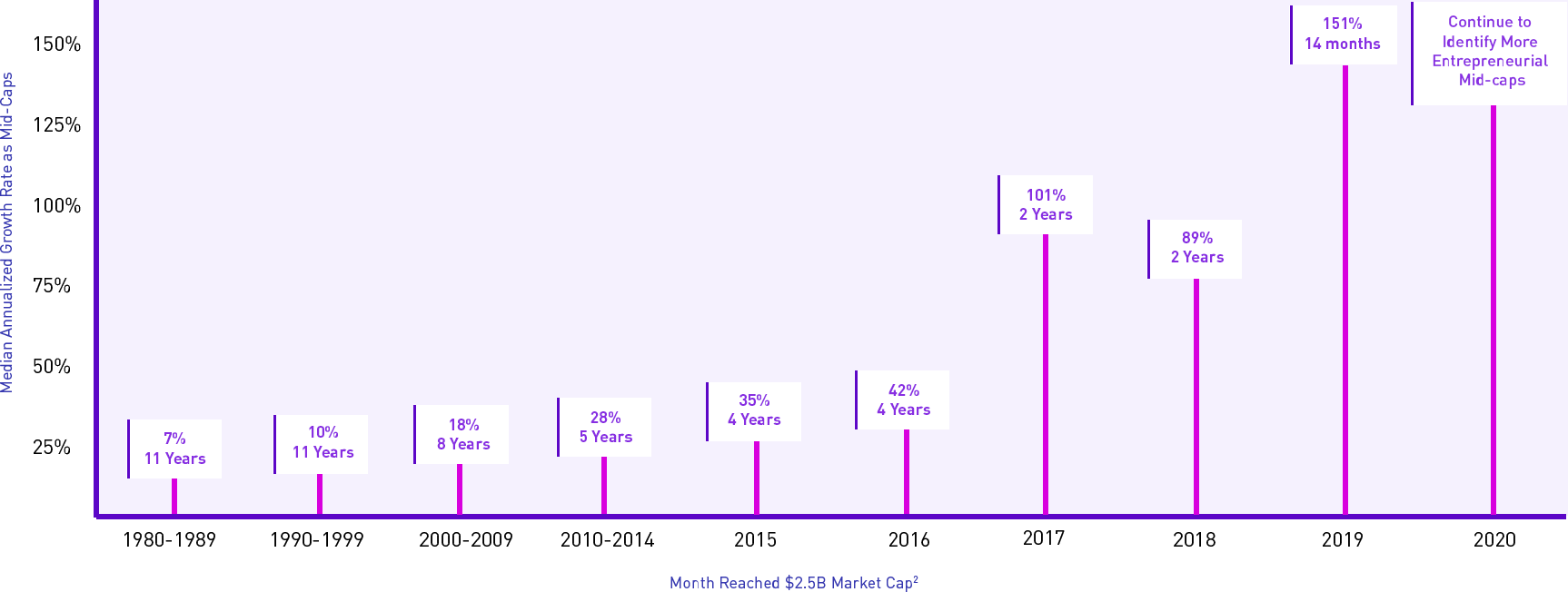

The Path From Small-Cap to Large-Cap

Click to view chart fullscreen

Mid-caps are experiencing greater than ever growth potentials nowadays

Mid-cap is defined by a market capitalization between $2.5 billion and $10 billion. Companies in this phase tend to experience high growth through an increase in profits, expansion of market share and improvement of productivity as their operations mature and they increase recognition. With the pace at which information technology is evolving, it is becoming more accessible for people to learn about companies, share their opinions, and actively participate in investing activities, boosting mid-caps to a faster growth pace.

Observing entrepreneurial companies in ERShares’ investment universe, over the past 35 years, the time taken to grow from a small-cap to a large-cap has shortened considerably. Before 2000, it normally took an entrepreneurial company over 10 years to expand from $2.5 billion to $10 billion, with an annualized return below 10%. Most recently, it has only taken companies 2 years to do the same, generating exceptional annualized returns for investors.

Strategy Objectives

Mid Cap Entrepreneur Strategy invests in publicly-traded Entrepreneurial companies that have a market capitalization of $2.5B to $10B. This strategy compiles the most high potential Entrepreneur companies as they pursue explosive, global growth opportunites. This strategy has traditionally generated exceptional risk-adjusted alpha.

Entrepreneurial Disruption

Disclosures

Performance quoted represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate so an investor’s shares, when redeemed, may be worth more or less than the original cost. Current returns may be lower or higher. For performance information as of the most recent month-end, please call us through www.ershares.com

This strategy is represented through a carve-out with gross-of-fees performance. The carve-out is a portfolio that is by itself representative of a distinct investment strategy. It is used to create a track record for a narrower mandate from a multiple-strategy portfolio managed to a broader mandate.

Investors should carefully consider the investment objectives, risks, charges, and expenses carefully before investing. For this and other information about the EntrepreneurShares products, please read the prospectuses carefully before investing. The prospectus can be obtained by contacting EntrepenreurShares at www.ershares.com