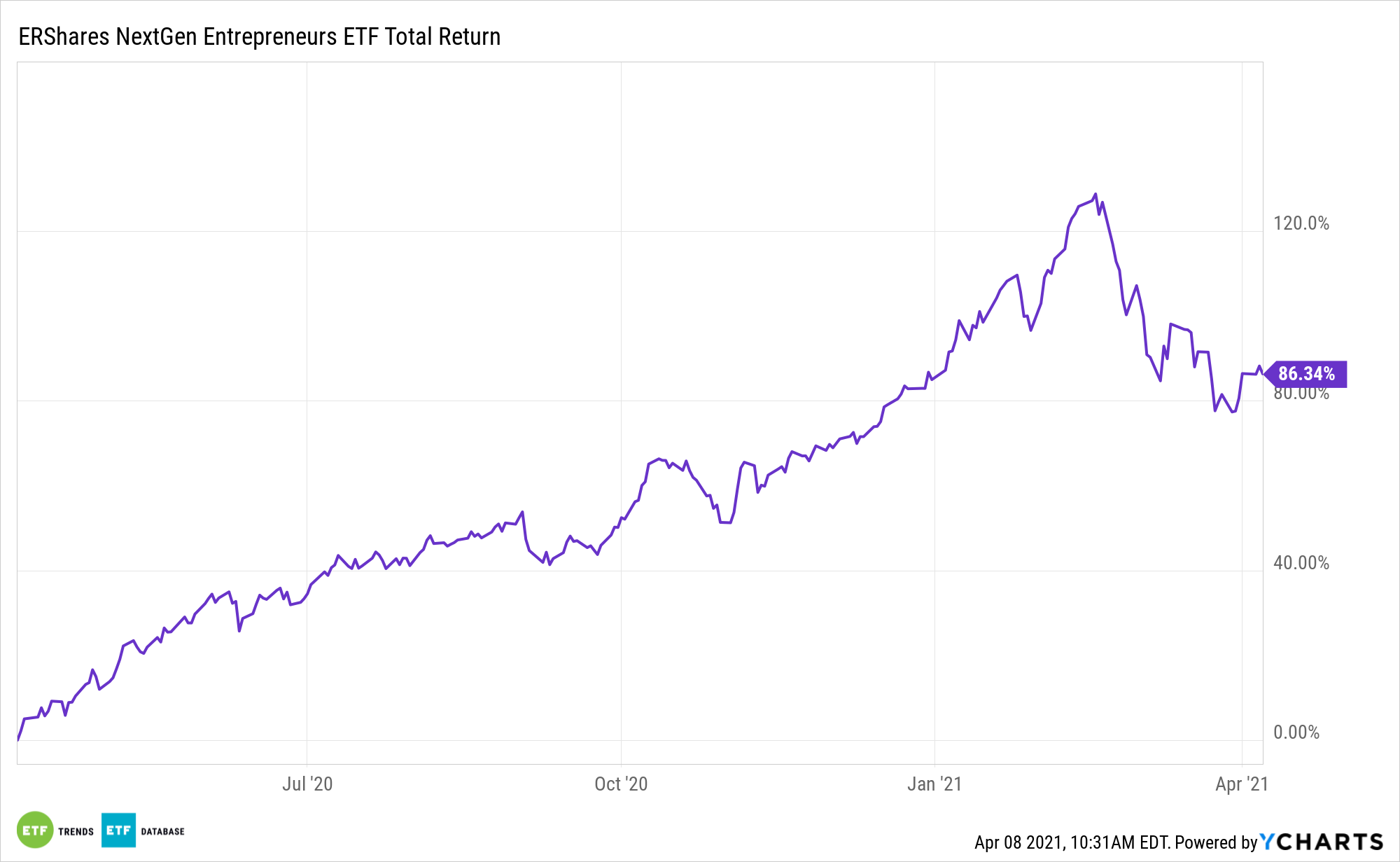

Fintech is one of the premier disruptive technologies. For investors chasing access to the broader industry, the ERShares Entrepreneurs ETF (ENTR) is an exchange traded fund worthy of strong consideration.

ENTR tries to reflect the performance of the Entrepreneur 30 Index, which is comprised of 30 U.S. companies with the highest market capitalizations and composite scores based on six criteria referred to as entrepreneurial standards. ENTR primarily invests in US Large Cap companies that meet the thresholds embedded in their proprietary Entrepreneur Factor (EF).

Fintech firms are companies that are powered by innovations, working to disintermediate or bypass the current financial markets and challenge traditional institutions by offering new solutions that are better, cheaper, faster, and more secure.

Stocks in this category, including Square and PayPal, have a myriad of tailwinds. Square and PayPal are currently challenging major credit card networks, a threat that is emerging more rapidly than many industry observers expected.

Investing in the Future of Fintech

Entrepreneurial FinTech companies such as Square are well positioned for explosive growth through customer acquisition, retention, and redeployment.

“Once consumers have grown accustomed to using primarily digital payments, many will not revert to traditional means,” according to UBS.

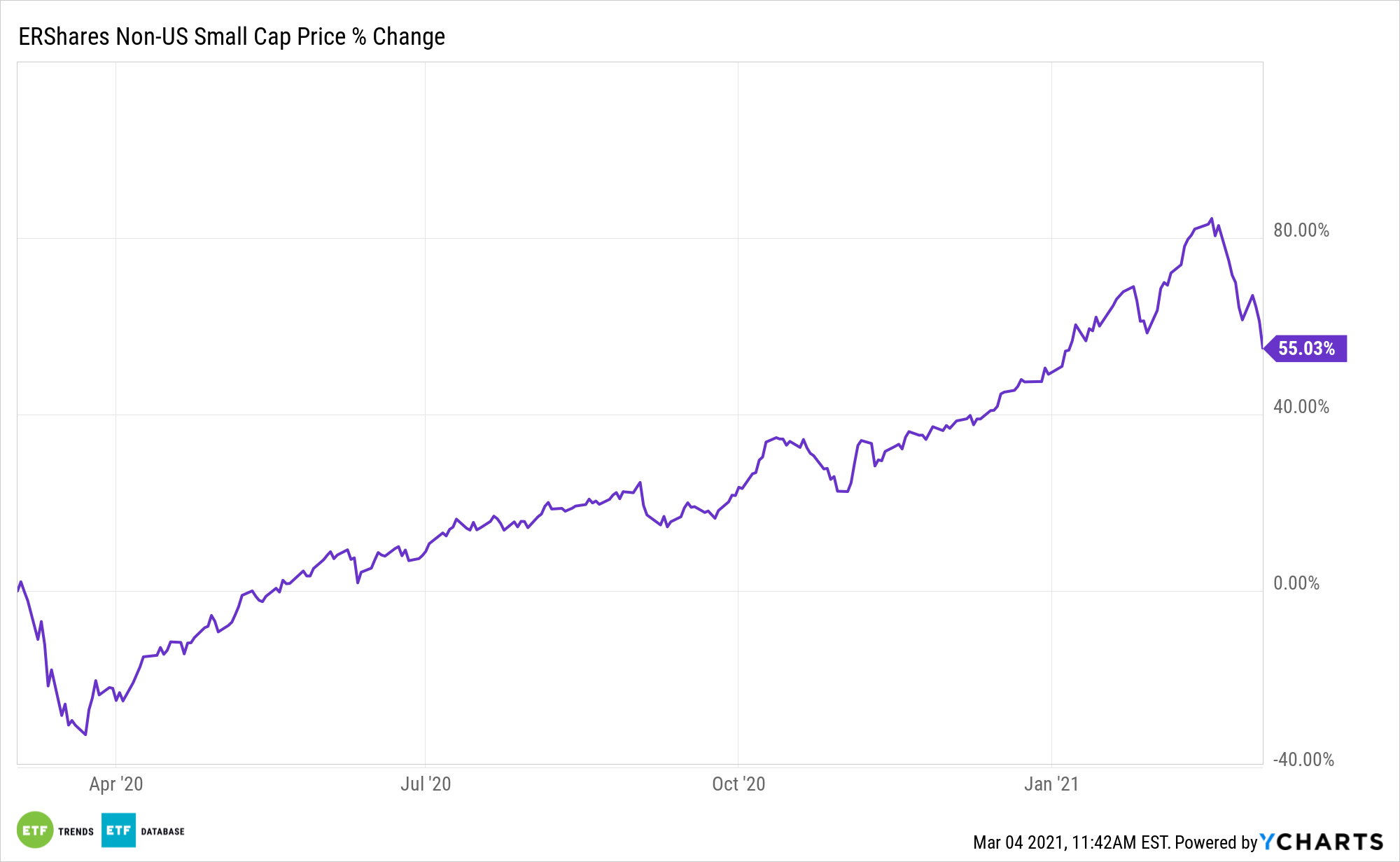

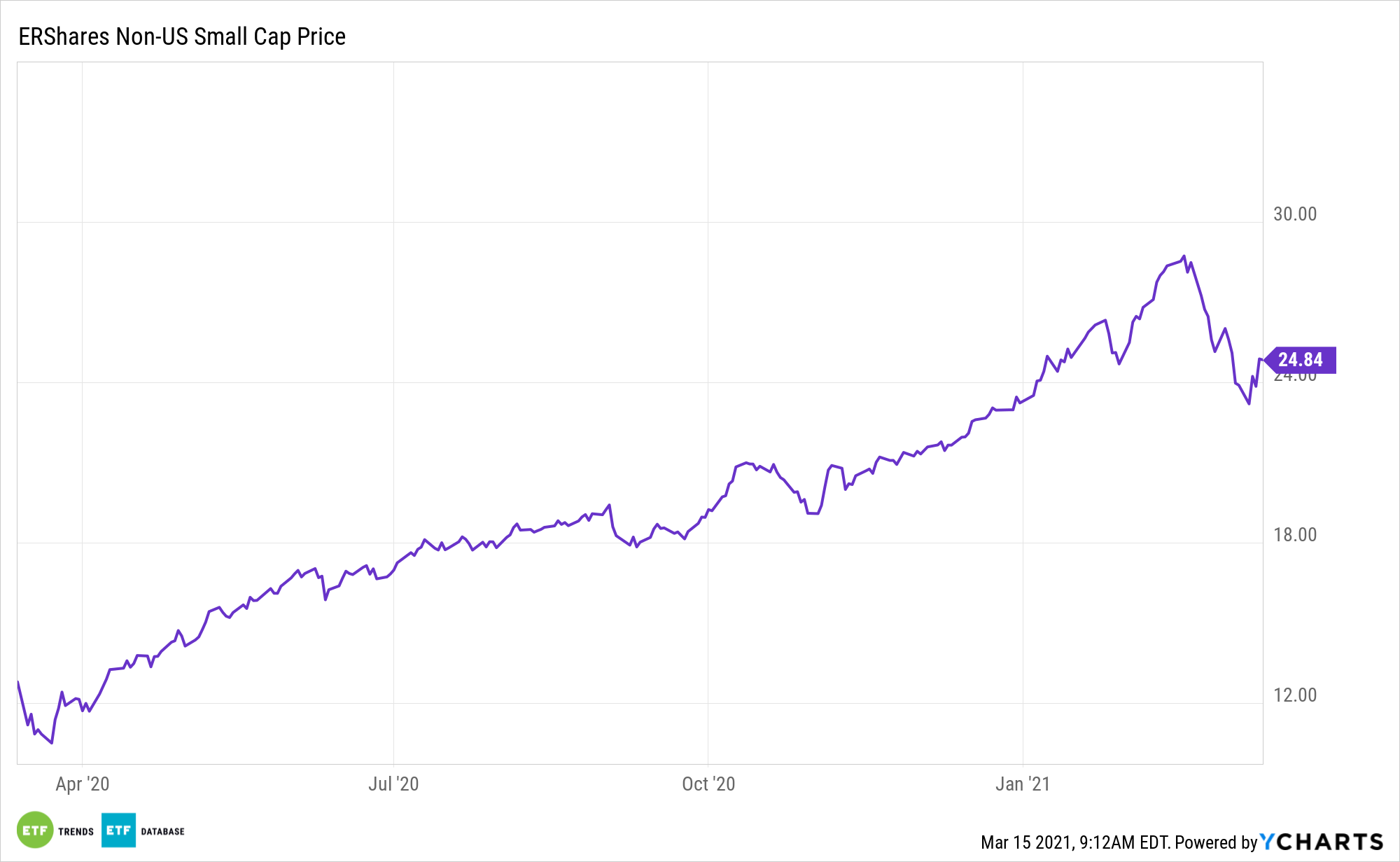

Adding to the allure of ENTR is the international reach of fintech, something the ERShares fund taps into.

The accelerating adoption of digital technologies in emerging economies will open growth opportunities for investors. Fintech is the middle man in the mass trend of disruption that is currently occurring with increased digitization. Once consumers can transact without friction online, then basic analog, communications, and relationships will shift online as well. Those themes are taking shape on a global scale.

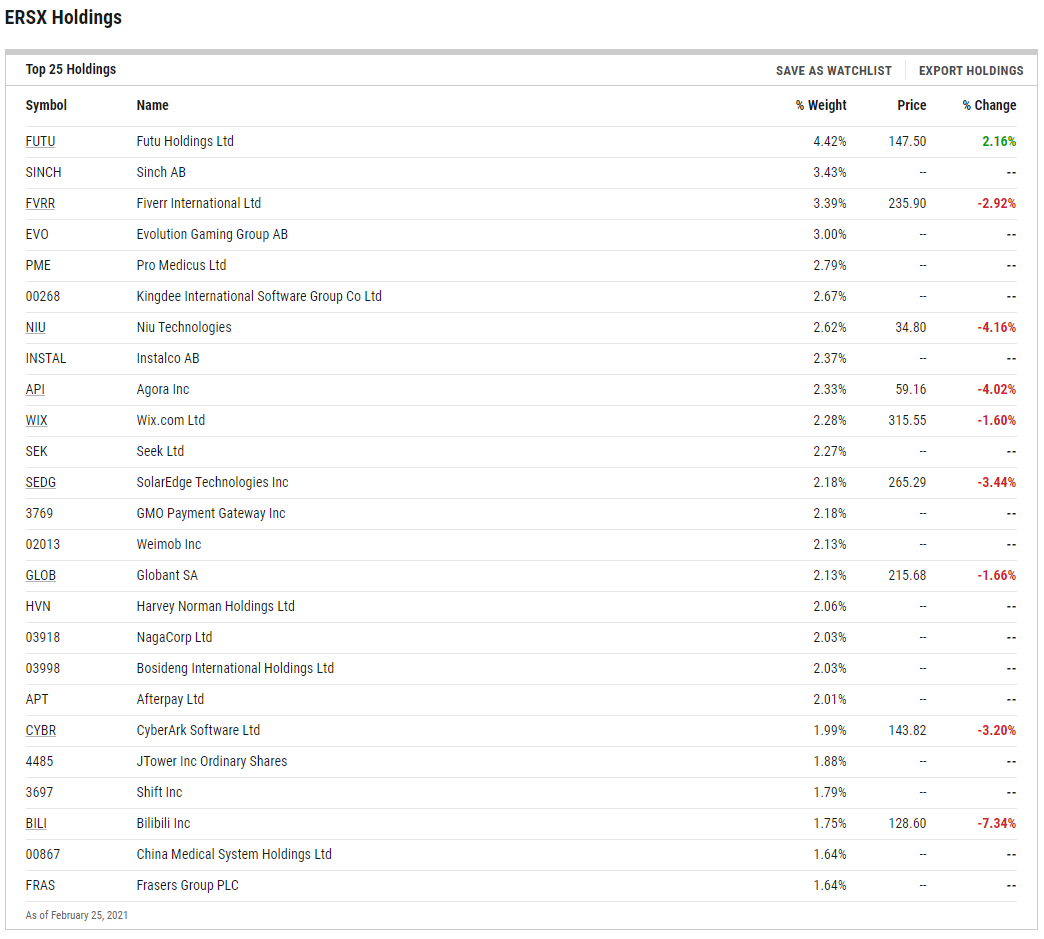

Not surprisingly, China is fertile territory for ex-US fintech opportunities. China’s household wealth will increase significantly over the next two decades and discretionary income there is on the rise. Historically, the Chinese have invested heavily in real estate and bank deposits. Now, they’re shifting to stocks.

Nevertheless, fintech in the emerging markets remains in its nascent stages. Affordability has been the major bottleneck to mass adoption, especially when compared to digital transactions in developed countries. That’s not a negative. In fact, it highlights a longer-term play for investment vehicles like ENTR.