Investors usually love domestic small caps. They can wade into their international equivalents with the ERShares NextGen Entrepreneurs ETF (ERSX).

ERSX selects the most entrepreneurial, primarily non-U.S. small cap companies that meet the thresholds embedded in its proprietary Entrepreneur Factor (EF). ERShares’ ETF delivers compelling performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics. Their geographic diversity enables them to harness global advantages through additional returns associated with currency fluctuations, strategic geographic allocations, comparative trade imbalances, and relative supply/demand strengths.

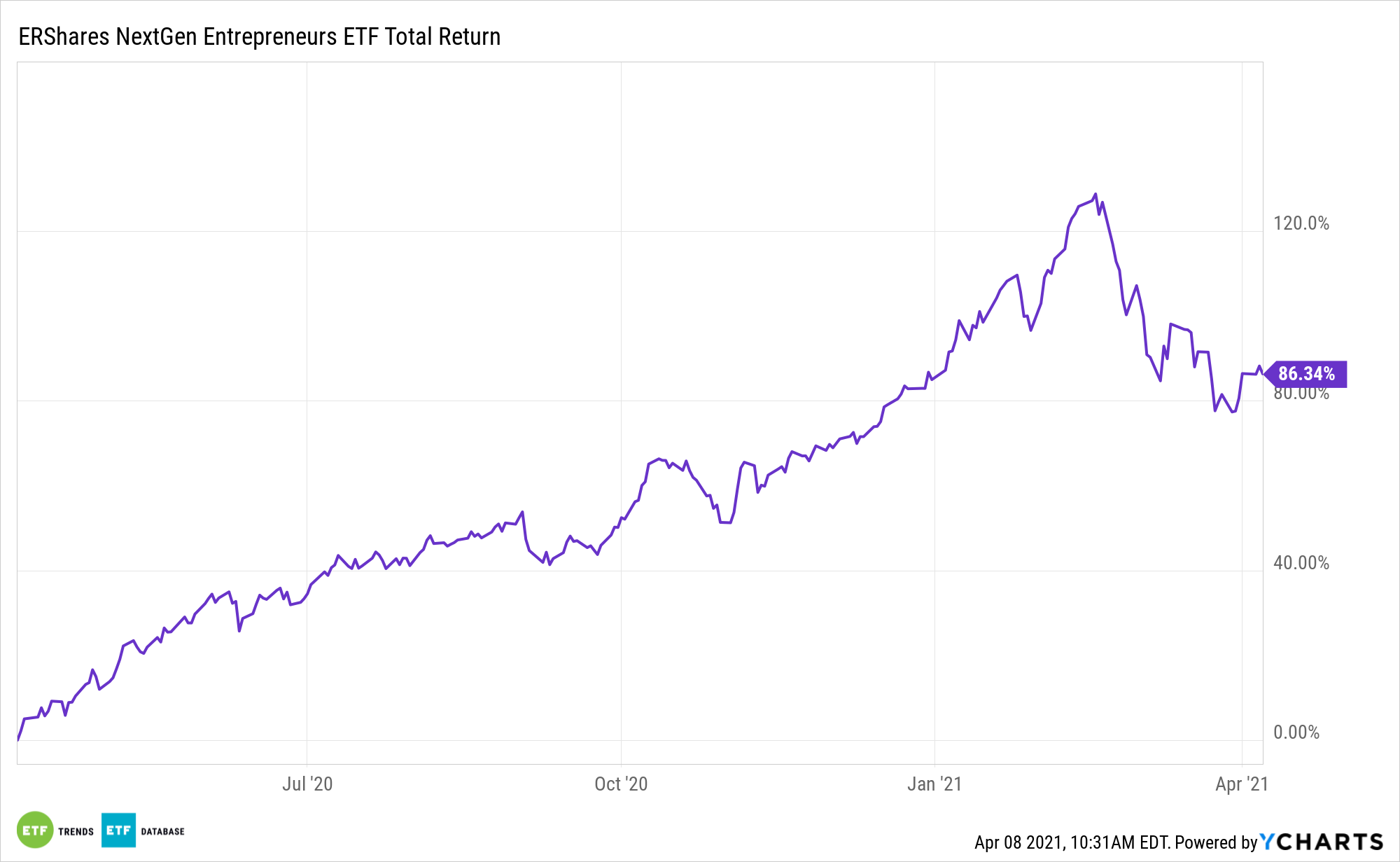

ERSX offers plenty of benefits in the current climate.

Small cap companies’ nimble nature may position them to quickly evolve to take advantage of structural economic changes. Simultaneously, value stocks have the potential to outperform growth stocks during economic recoveries, with value-oriented industries tapping into pent-up demand created by the pandemic.

Global Pockets of Opportunity

With some long-running market trends poised to reverse this year, ERSX is all the more appealing.

“We’d be remiss to ignore the valuation profile of international small-cap value as well. Despite the attention they’ve earned this year, coupled with an impressive performance record, small-cap value stocks around the world still trade at comfortable discounts to their large-cap peers. That tells us that investors are not yet as serious about small caps as they should be, which creates an advantageous opportunity,” according to WisdomTree research.

Increasing the allure of ERSX, international small caps are generally export-oriented, globally-structured, innovative, and have a high to dominant share of a niche market, often one in which the U.S. counterparts don’t compete effectively.

Looking ahead, international equities have increasingly become an attractive option for investors looking to generate income and pursue higher total return potential. Investors may want to take cues from institutional players today and not wait until 2022 for international allocations.

“Even with their auspicious start to the year, international small caps are still lagging U.S. small caps, so the inexpensive valuations of the former should reassure you that they may still have room to rally further without fear of overpaying,” adds WisdomTree.