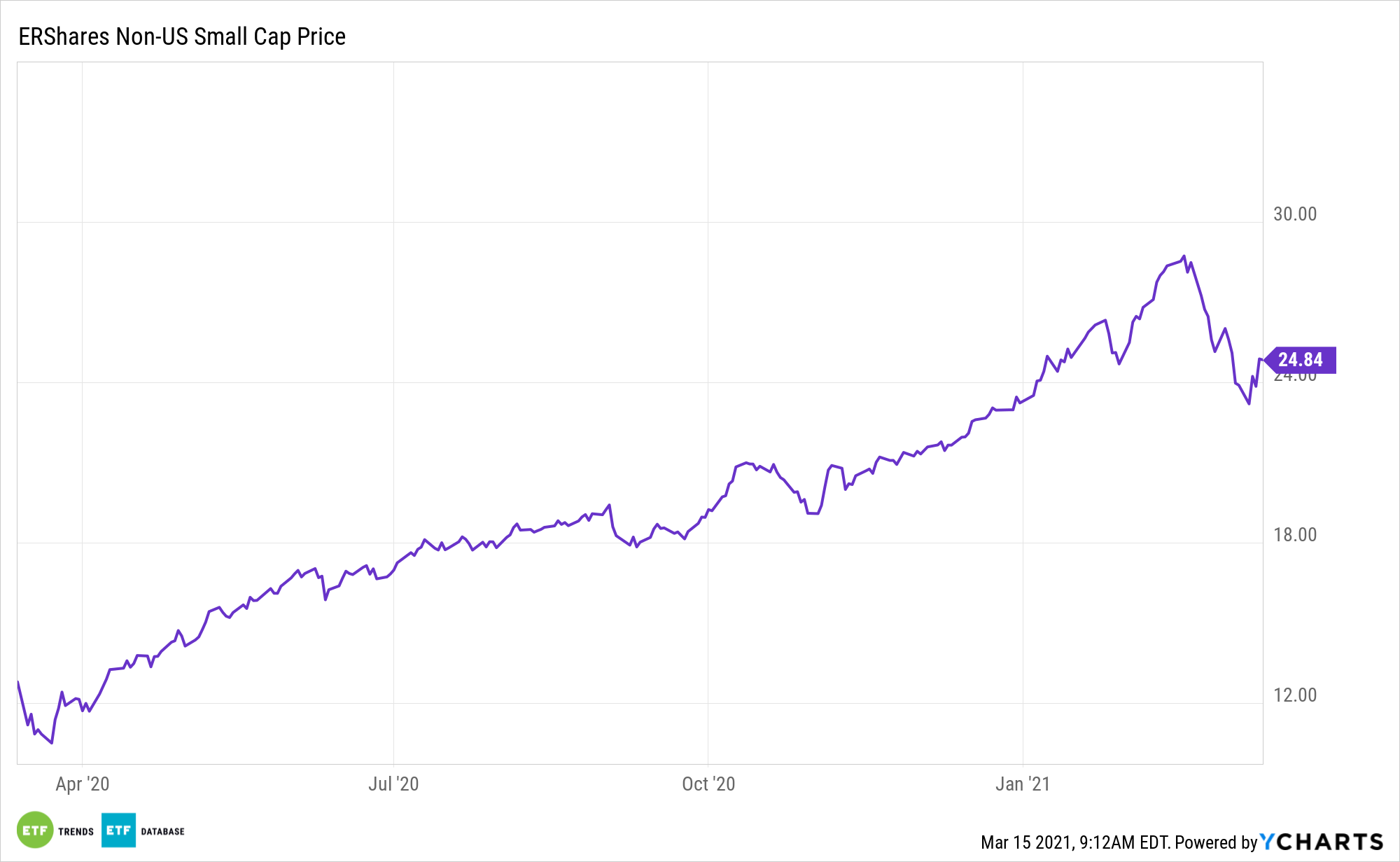

International small caps are one of the most overlooked asset classes in the ETF investing space. The ERShares NextGen Entrepreneurs ETF (ERSX) is showing investors exactly why this group shouldn’t be ignored.

ERSX selects the most entrepreneurial, primarily Non-U.S. Small Cap companies, that meet the thresholds embedded in its proprietary Entrepreneur Factor (EF). ERShares’ ETF delivers compelling performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics. Their geographic diversity enables them to harness global advantages through additional returns associated with currency fluctuations, strategic geographic allocations, comparative trade imbalances, and relative supply/demand strengths.

“For several years, investors have done well by focusing on megacaps. But over the long term, foreign small- and midsize companies—or ‘smid’—have outperformed other types of companies, particularly in Europe and Japan,” reports Reshma Kapadia for Barron’s.

The Case for ‘ERSX’

International equities have increasingly become an attractive option for investors looking to generate income and pursue higher total return potential. Investors may want to take cues from institutional players today and not wait until 2022 for international allocations.

“In addition to being well-positioned for a recovery, the relative valuation for global SMID stocks is also attractive,” adds Barron’s. “Those foreign stocks are typically cheaper than their U.S. counterparts. Picking small- or midsize stocks can be hard in the U.S.—and even more difficult abroad—so a diversified, index-based approach may be easier for investors.”

Building wealth can be a painstaking process in a world where most are seeking immediate returns. Yet for those brimming with discipline, small increments allocated toward small cap strategies can pay off in the long run.

While small cap value appears to be solidifying, that doesn’t mean small cap growth is going to lag. Fortunately for investors, the ERShares ETF addresses both factors.