Entrepreneurial Companies Create More Jobs

Many of the rising top companies today are entrepreneurial companies. In addition to providing millions of jobs, these companies continue to amaze us with their innovations and creativity. In this paper, we analyze job growth and salary increases across industries. We also compare these metrics between entrepreneurial companies (as defined by the ERShares proprietary Entrepreneur Factor) and the S&P 500.

Identify Job growth

Entrepreneurial companies have created jobs for Americans throughout the years. With the information provided, we were able to identify the jobs growth in the ER30 index (the ER30 Index or Entrepreneurial 30 Index is a selection of 30 well-established entrepreneurial companies that are publicly traded) in comparison to the S&P 500.

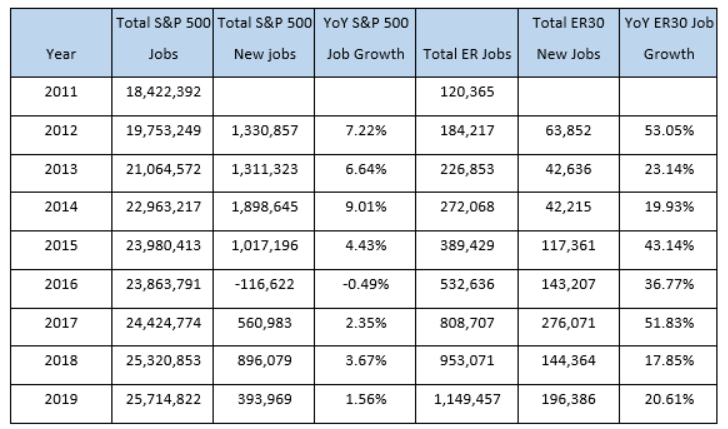

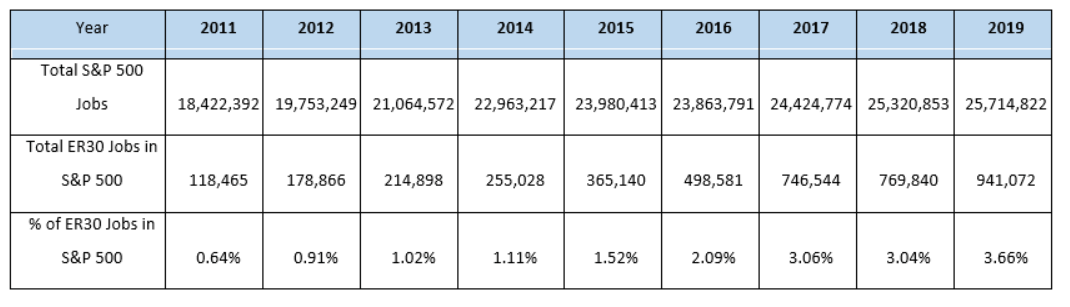

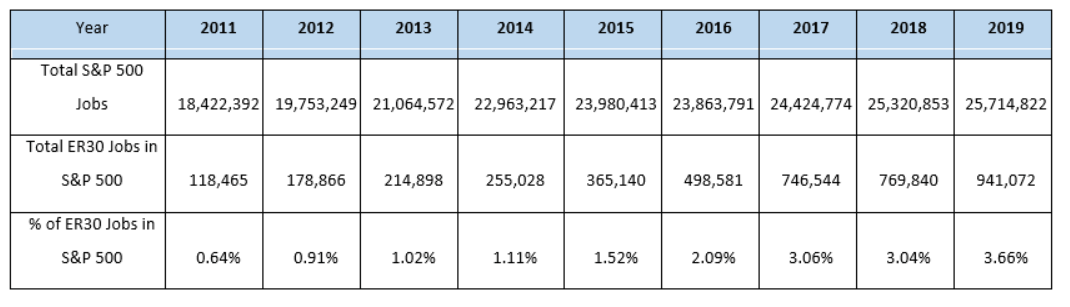

Table 1

S&P 500 vs. ER30 Job Information

Table 1 shows the total jobs each year from 2011-2019, the number of new jobs created these years, and the year-over-year (YoY) job growth percentage in both the S&P 500 and ER30. Comparing the job growth data of the S&P 500 and ER30, it is surprising to see how many more jobs are being created by entrepreneurial companies over the years. It is important to note that the job data excludes major acquisitions. This means that entrepreneurial companies grow organically and not through mergers and acquisitions. Specifically, from 2011 to 2019, the companies included in the ER30 grew in jobs by around 1000%, while the S&P by a little less than 50%. This result illustrates how fast the entrepreneurial companies create organic job growth.

Table 2

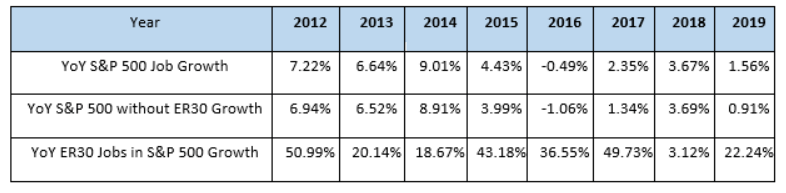

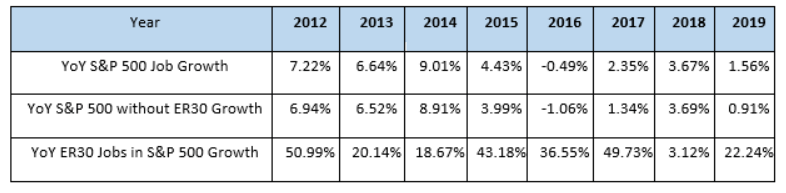

Year-over-year Job Growth Comparison

Table 2 shows the year-over-year job growth rate for the S&P 500 after removing any the ER30 company which is also included in the S&P 500

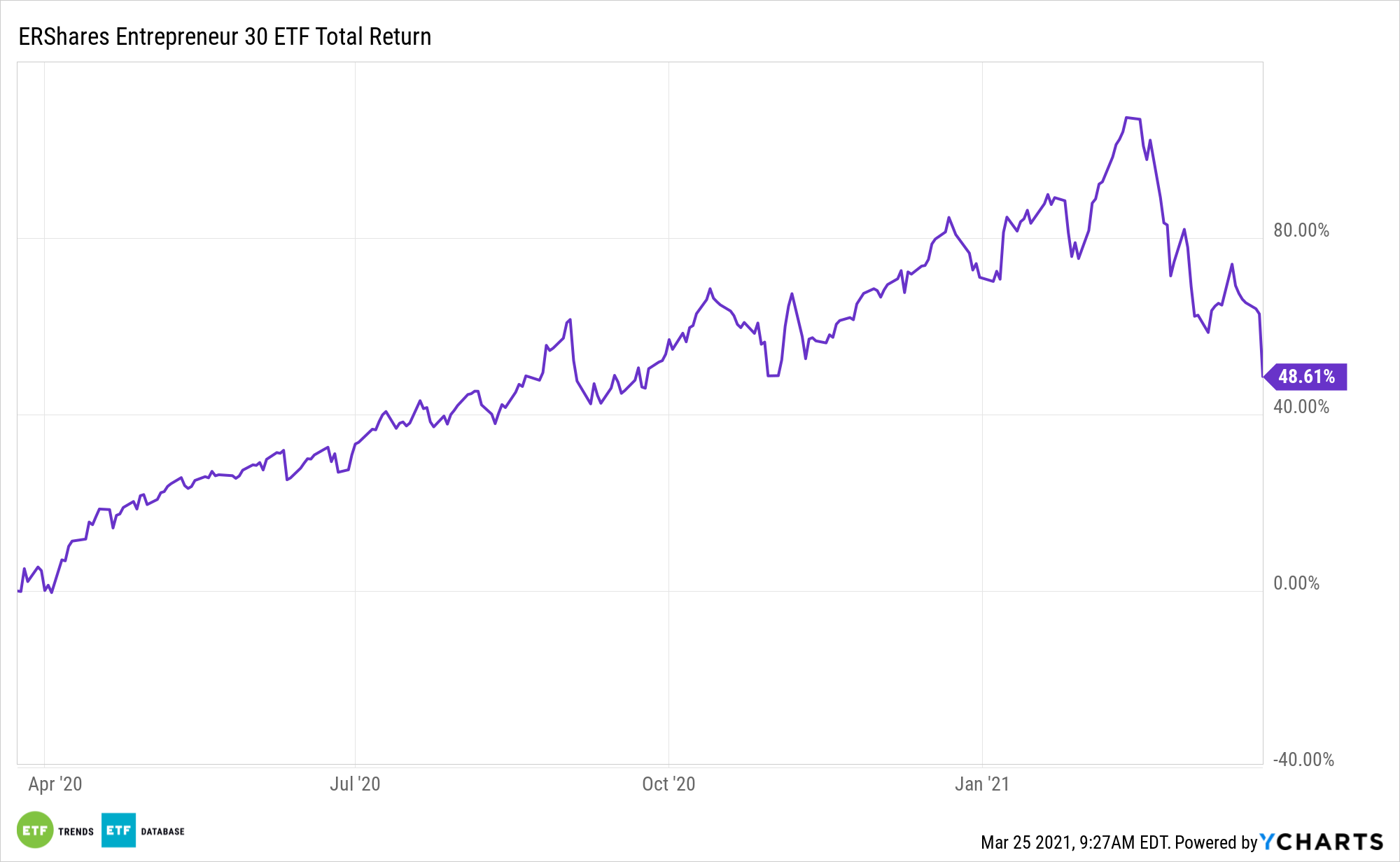

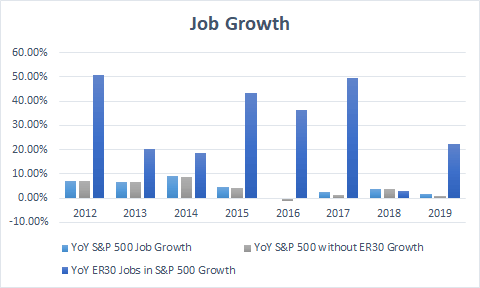

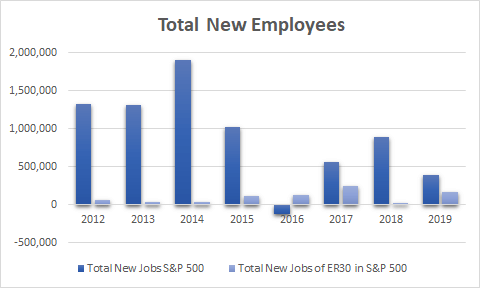

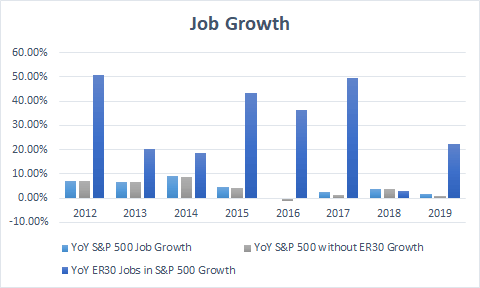

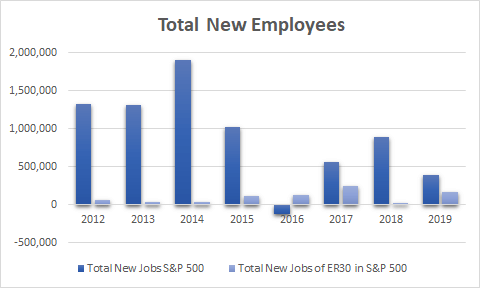

Figure 1

Figure 1 visualizes the job growth of the ER30 companies, comparing them to the total job growth of the S&P 500 and the whole U.S. (the table with the information found on the reference page). We observe that on a year over year basis, entrepreneurial companies have been the dominant leaders in terms of job growth, and the trend doesn’t seem to be slowing down.

Which Companies Created the Most Jobs?

Amazon.com employs over 1,298,000 people as per their fourth quarter’s earnings report. This number dwarfs any other in the list. It is also important to note that this number excludes contractors and temporary personnel. Moreover, with year-over-year growth of 63 %, it has created, by far, the most jobs out of any other S&P 500 company. Part of Amazon’s explosive job growth in 2020 can be attributed to the Covid-19 pandemic, which accelerated e-commerce in a big way. From Amazon Web Services to Amazon Prime streaming services, several revenue streams benefited from the pandemic, lifting Amazon’s worth to almost 1.65 trillion U.S. dollars. It is not an exaggeration to state that Amazon’s success is vastly owed to Bezos’ entrepreneurial mindset and the entrepreneurial culture he has created in Amazon, allowing Amazon to disrupt every industry it has entered.

Another example of entrepreneurial success is Alphabet Inc., Google’s parent company, which ranks second in job creation in the past decade. Currently, Alphabet employs almost 140,000 as per their latest press release (2021 first-quarter report). Google created more than 16,000 jobs in just the first quarter of 2021, with most of those employees working on Google Search and Google Cloud.

In addition to being one of the most prominent employers, Google boasts the highest average salary in the technology sector.

Which Industry Created the Most Jobs?

Among all industries, the service-providing industry has seen the most growth in recent years. Especially, services that have to do with data processing, information technology operations, and related consulting have surged even during the pandemic. The new work-from-home culture entirely benefits from online systems technology. In the Information and Technology sector, e-commerce and Fintech are among the fastest growing industries.

[2]

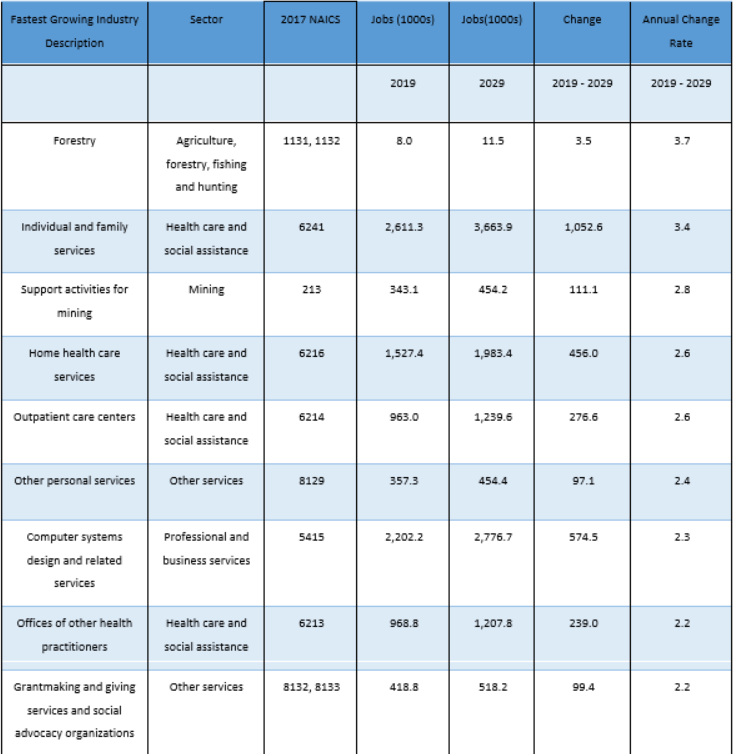

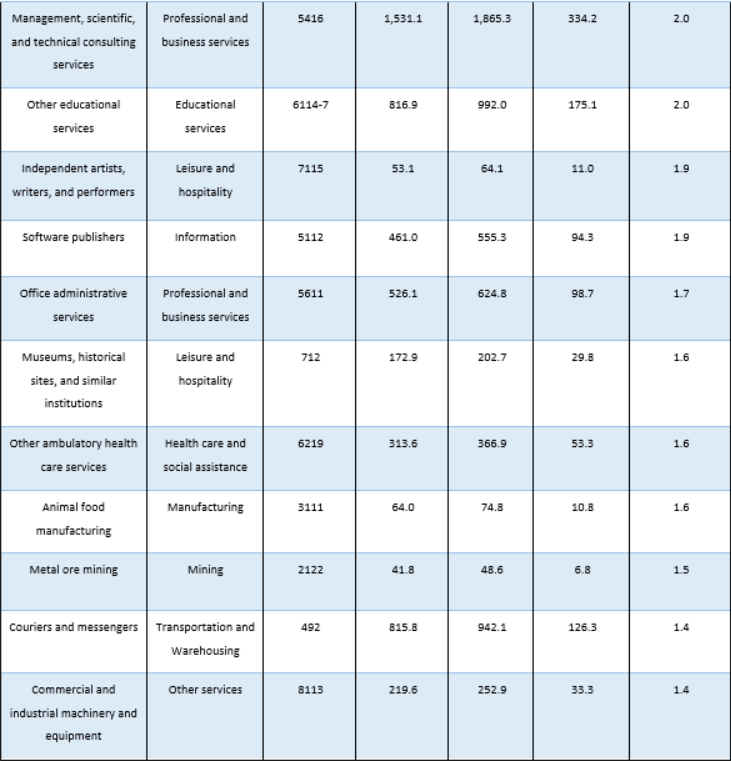

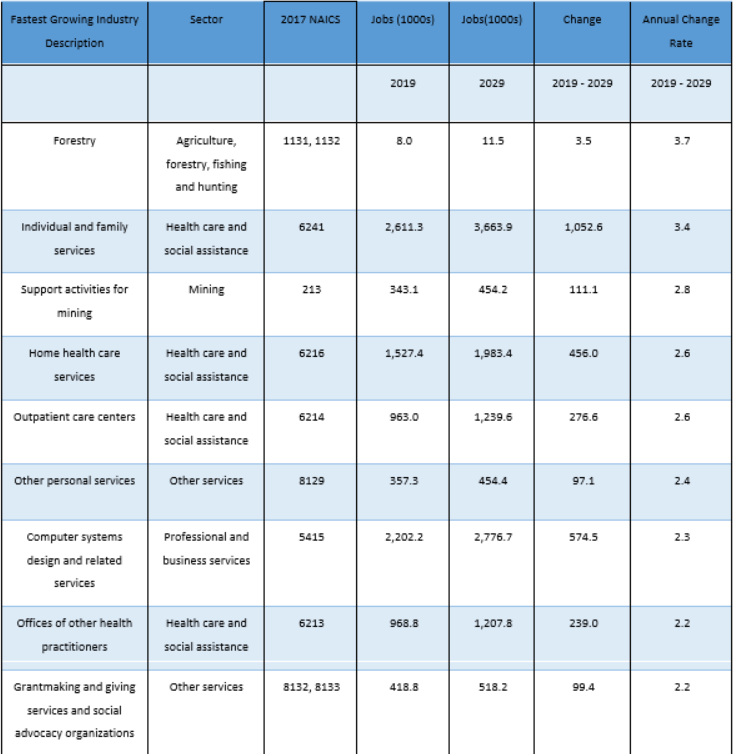

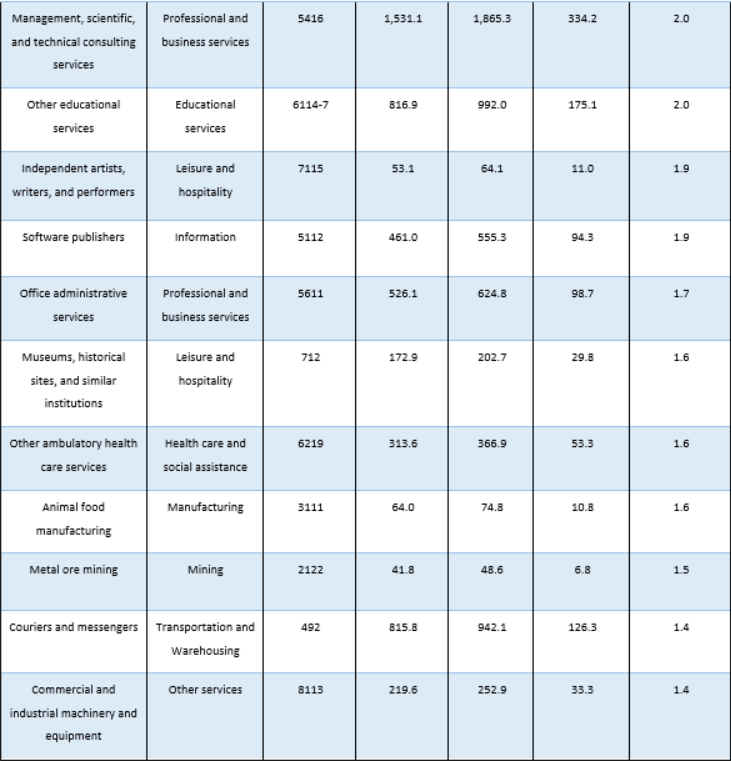

In addition to that, the U.S. Bureau of Labor Statistics states that healthcare and social assistance is the fastest-growing major sector in the economy, which includes five out of the 20 fastest growing industries for the next decade. Specifically, the Bureau of Labor Statistics projects that employment in healthcare occupations will grow 15 percent from 2019 to 2029. The rate of growth is much greater than the average for all occupations and represents about 2.4 million new jobs created.

Compared to the rest of the sectors, the outperformance can be attributed to the aging population due to longer life expectancy and the constant increase in patient numbers with chronic conditions.

Which industries lost the most jobs?

Growth within industries has often fluctuated depending on the popularity or trends.

Formerly successful industries are way past their hay days. The manufacturing industry experienced the greatest job decline before the COVID-19 pandemic.

Furthermore, looking beyond the pandemic, even though manufacturing itself might not be declining, machinery and automation is reducing jobs on a big scale. Another industry that has undergone an interesting transformation is the information industry. A distinction can be made now between digital and print information.

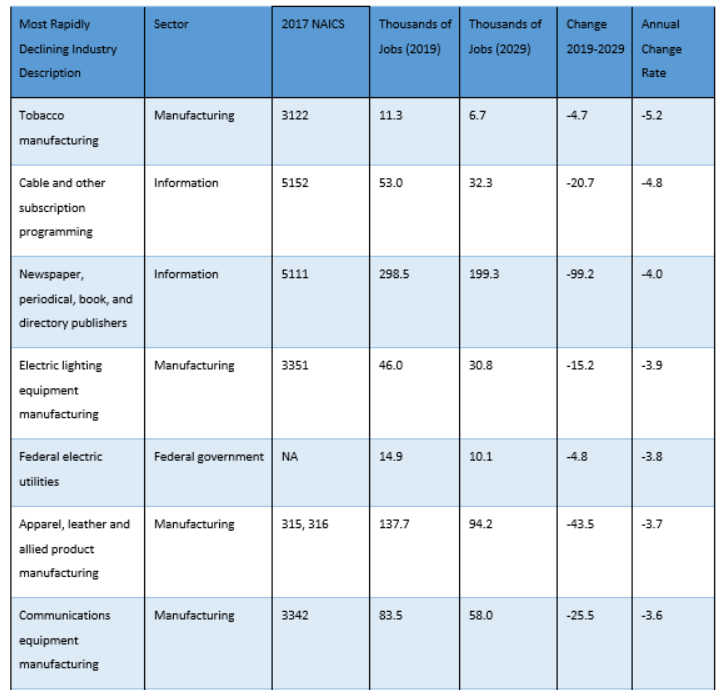

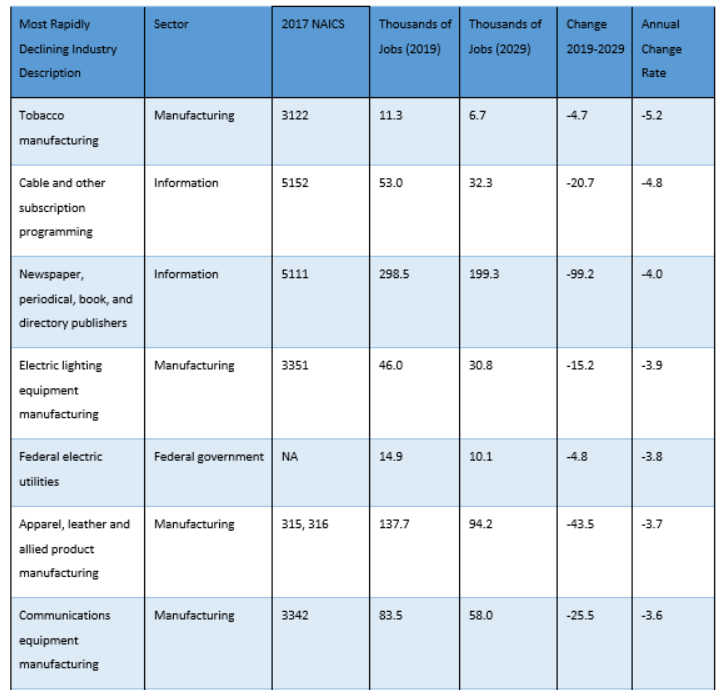

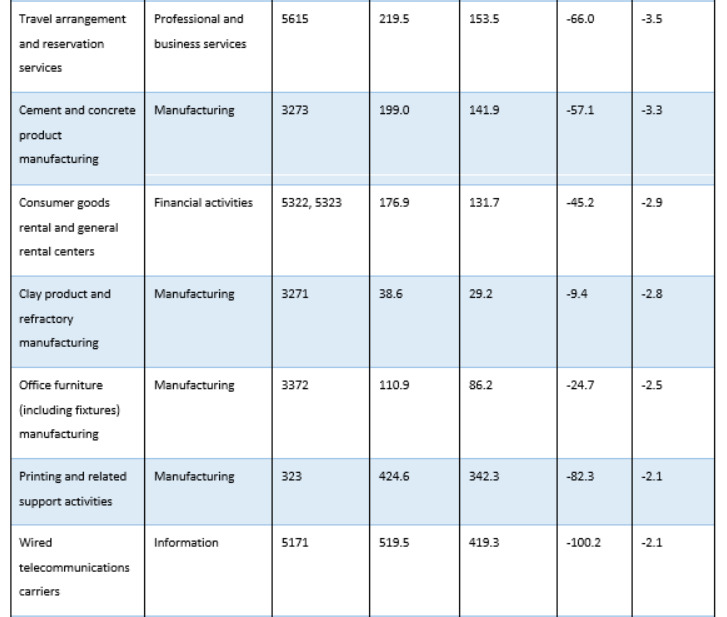

The following table shows that newspaper, periodical, book, directory publishers, cable and other subscription details, and wired telecommunications carriers, are the most in decline.

Today, it is easier to find news on social media or company websites, as most news is published on digital platforms. The cable industry has also suffered due to services such as Apple TV, Netflix, and Hulu.

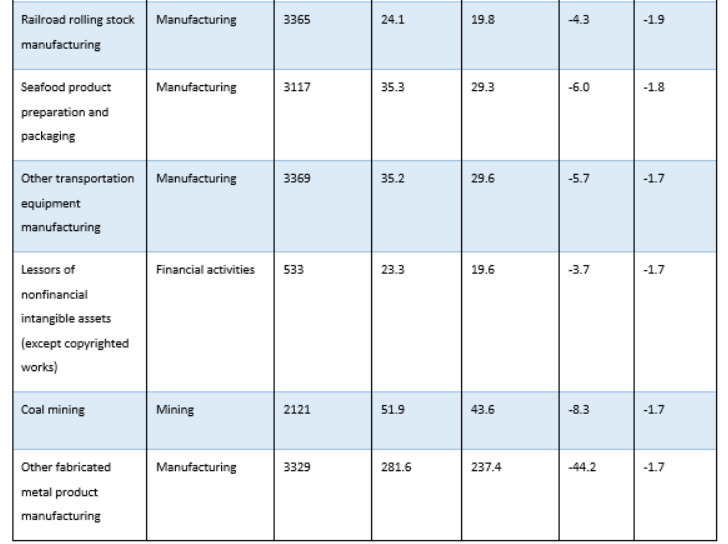

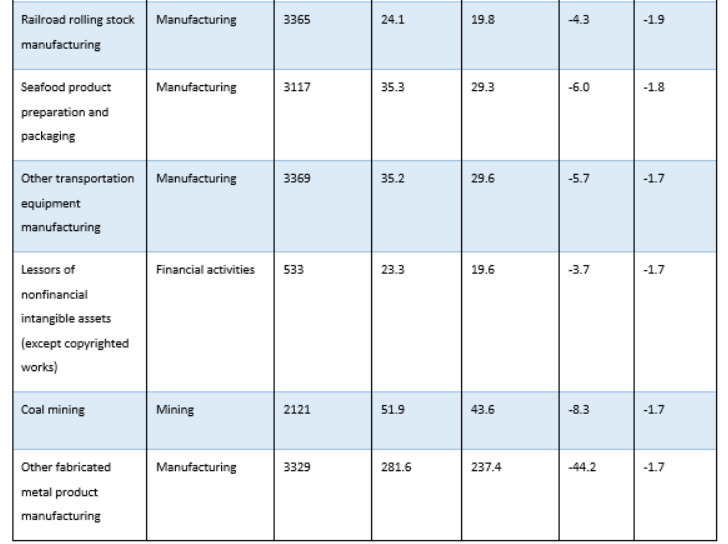

Table 3

[3]Most Rapidly Declining Industries

Table 4

Fastest Growing Industries

COVID-19 has fundamentally altered the way industries work today. Every industry and industry sector experienced a dramatic shift.

Sectors such as retail, hospitality, and leisure have been struggling, while technology companies have prospered. Some of the industries seem to be coming back to the pre-pandemic levels of operation; however, it is very plausible that the pandemic has affected specific industries irreversibly.

Which companies created the highest paying jobs?

Five companies in the ER30 rank in the top ten highest paying salaries according to CNBC.[4] Salesforce ranked number nine with median compensation of $150,379. First was Nvidia in number two in the list, with a median compensation of $170,068. Next, was Twitter ranking third with median compensation of $162,852. Alphabet, then ranked number five with a median compensation of $161,254. Facebook was eighth with a median compensation of $152,962.

In light of this report, the success of entrepreneurial companies is also evident in the extraordinary ability of these companies to provide employment and growth in the economy.

How much of the job growth is created by entrepreneurial companies?

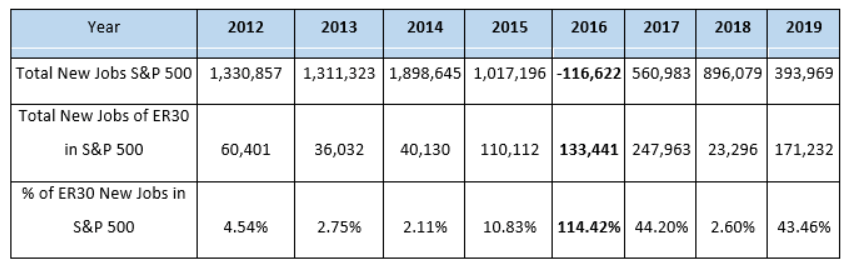

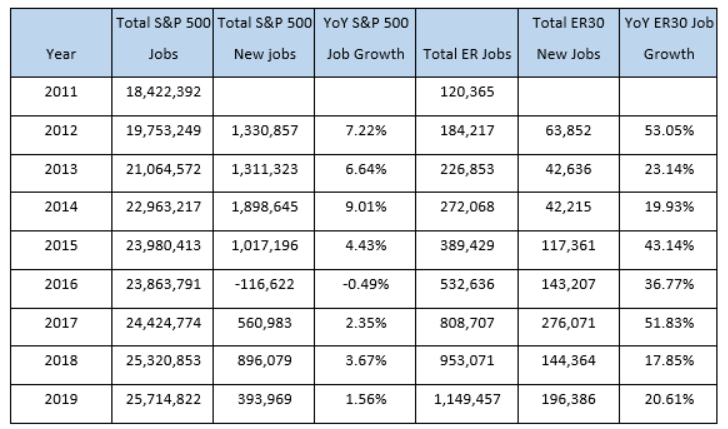

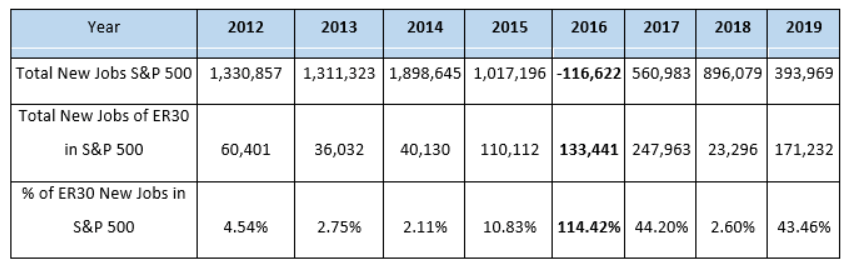

In Table 5, we can observe a widening gap over the years between the job growth achieved by entrepreneurial companies and the rest of the S&P 500.

In 2019, we can see that 43.46 percent of jobs created by the S&P 500 that year came from companies listed in the ER30 index.

Table 5

Percent of ER30 New Jobs when compared to New Jobs in S&P 500

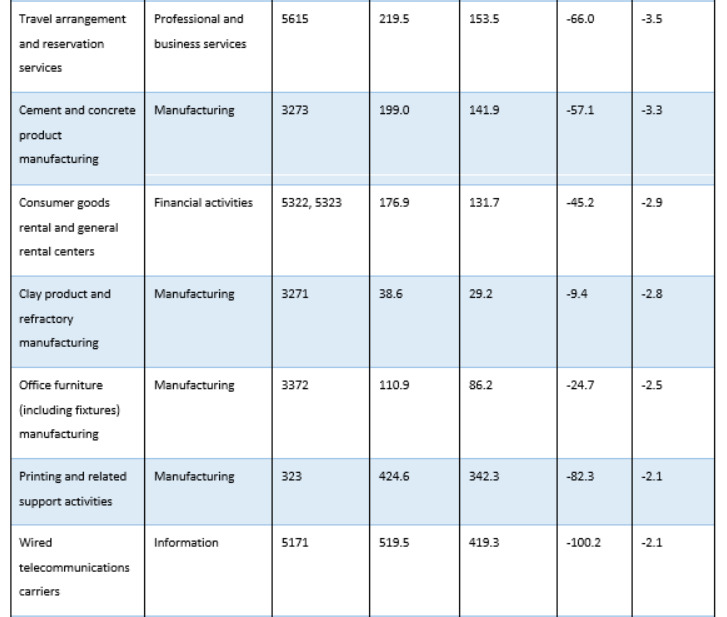

In figure 2, we notice that over this past decade, the total new jobs created in ER30 increasingly influenced the total increase of jobs in the S&P 500. Specifically, in 2019, companies in both ER30 and S&P 500 are credited for a little less than half of the new jobs created in the S&P, which is impressive. This finding is also evident in table 6

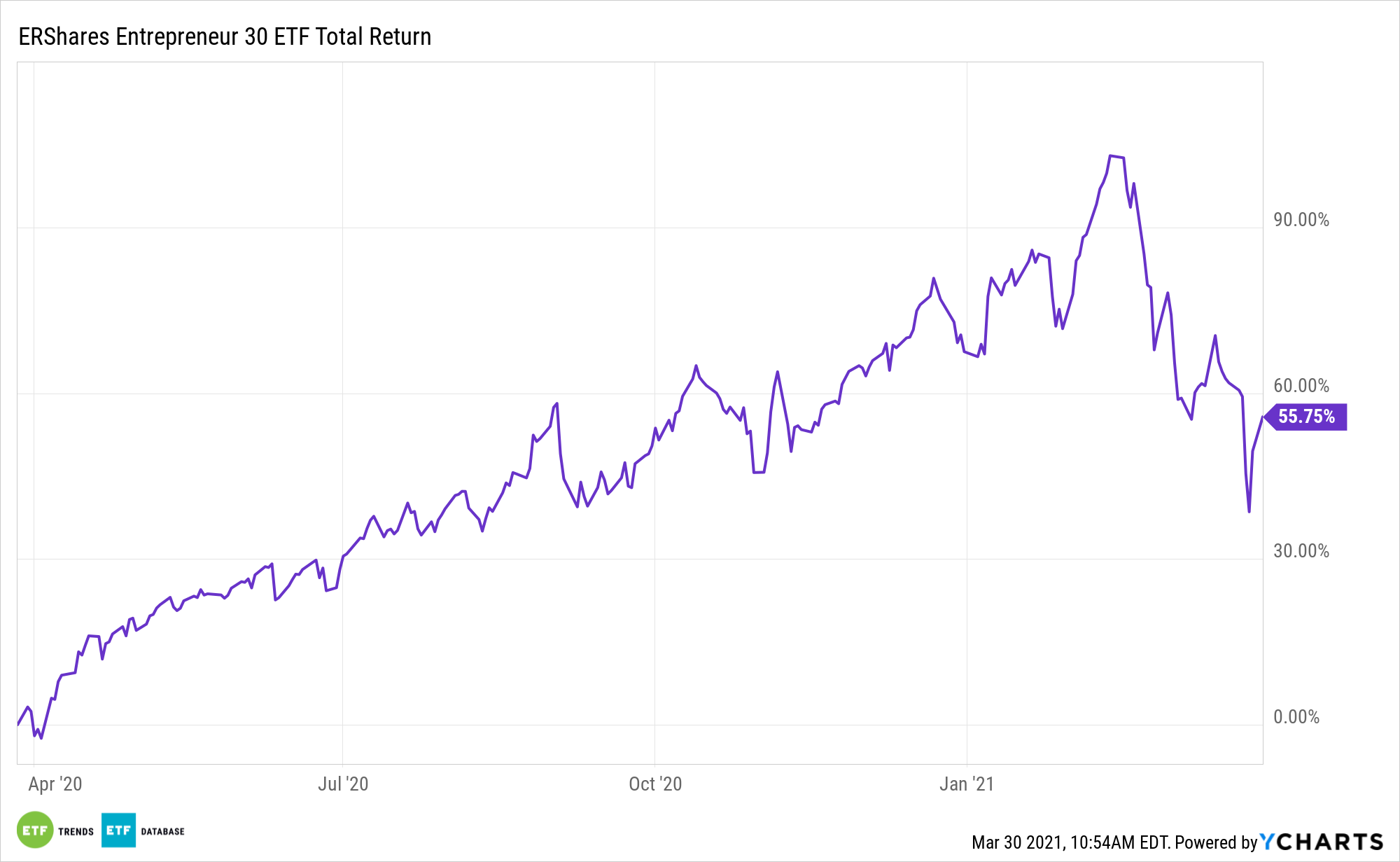

Figure 2

Table 6

Percent of ER30 Jobs in S&P 500

In table 6, we report the total jobs per year in the S&P 500 and the Total ER30 Jobs in the S&P 500. We observe that in 2019, the ER30 companies employed almost 1 million people or 3.66% of the total jobs in the S&P 500. That percent has grown since 2011, when it was only 0.64%.

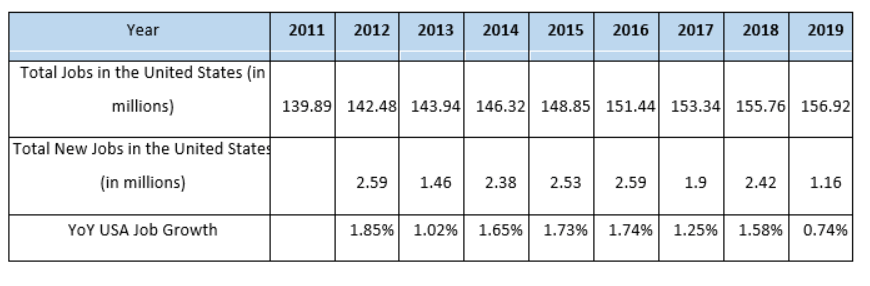

Table 7

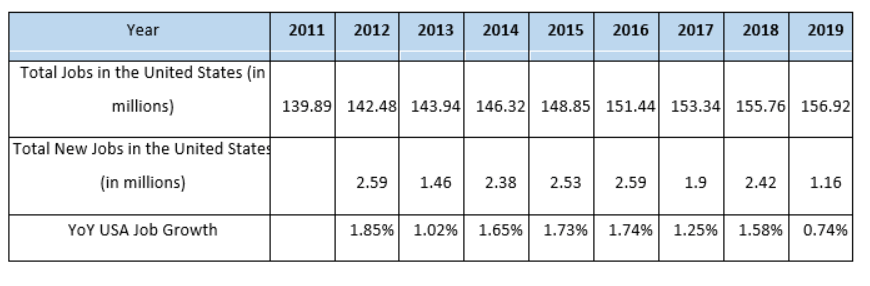

United States Employment Information[5]

After years of academic research demonstrating that entrepreneurial companies create more jobs than non-entrepreneurial companies, we believe this will be the case in the future as entrepreneurial companies continue to create more value in our societies compared to traditional companies.Despite the difficulties and challenges companies had to face over the past decade, such as COVID-19, the employment opportunities offered by entrepreneurial companies have been increasing fast over the years. Through innovation and dedication, entrepreneurs have succeeded time and again in creating wealth through their fast growth and providing employment opportunities while raising salaries at the same time, thus, benefiting the economy.