As inflation fears recede and investors shift back toward risk asset classes once more, opportunities are emerging in both growth and value stocks, said Joel Shulman, founder and CEO of ERShares, in a recent interview with Cheddar’s The Open.

In the interview, he offered his viewpoints on the prospect of rising inflation, the strong potential for tech stocks in the latter half of the year, and why investors should avoid Bitcoin.

“Inflation… has been the story all year”

So far, the worst of inflationary fears have not yet materialized in the market, said Shulman. “In terms of inflation, what we’re focusing on are wages which are still below July 2020 levels, (and) we’re seeing the most job vacancies ever,” he said.

He also pointed out that food prices, a significant indicator of real inflation, were only up 2.2% last month.

Shulman did caution that the Federal Reserve could potentially end up overextending itself with bonds.

Currently the Fed is committed to buying $120 billion worth of Treasury bonds and mortgage-backed securities per month, which is keeping interest rates artificially low. If the Fed were to reduce or cease its purchasing program, Shulman says, “we’re going to have some problems.”

“We think tech is well-positioned for the second half of the year”

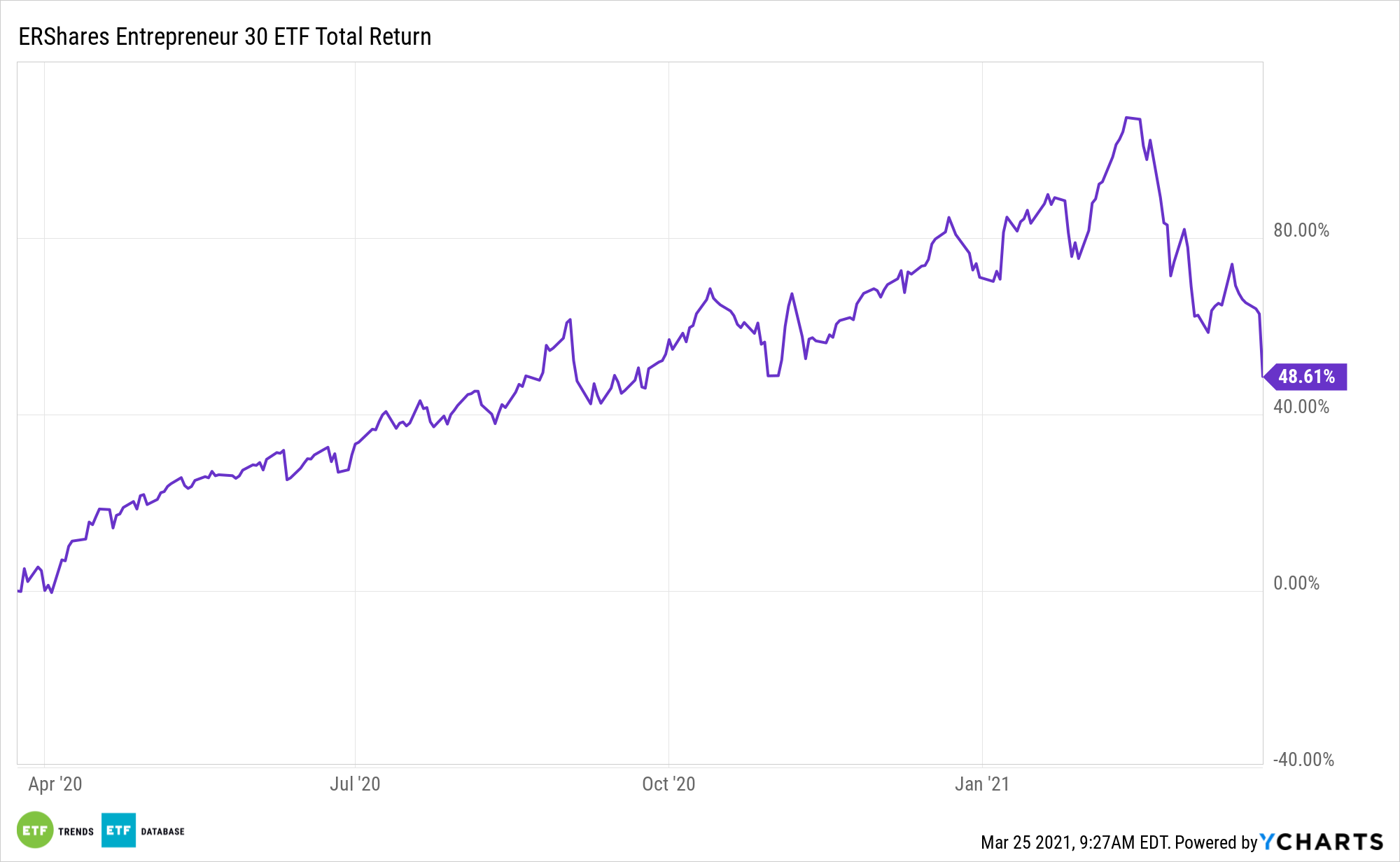

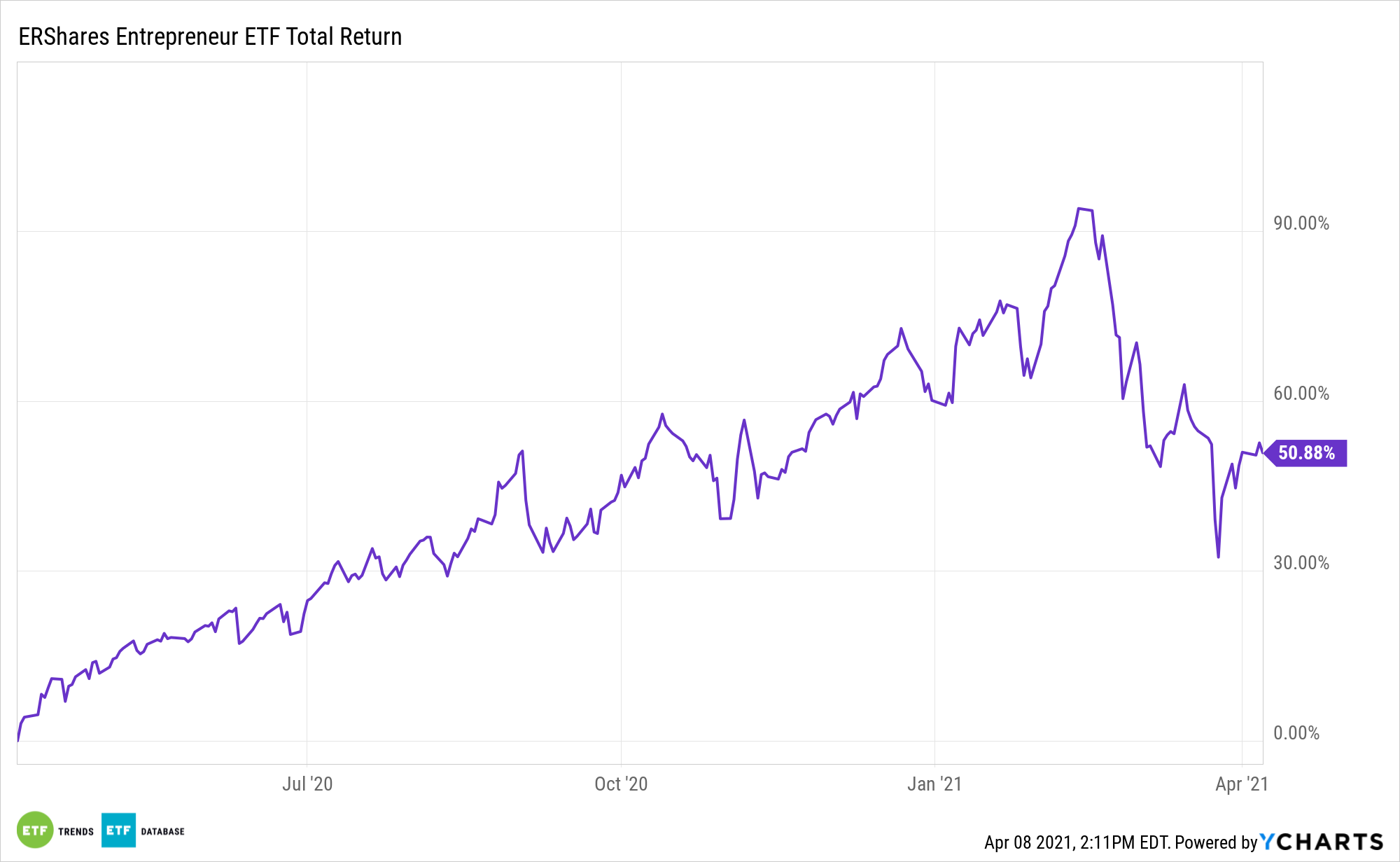

Tech stock prices have been oscillating a lot lately, many having reached highs in February before dropping at the end of the month; only to follow the same pattern in March through May.

“We are optimistic going forward with tech, especially high growth tech because we think they’re good opportunities now,” Shulman said.

With value stocks falling off of recent highs, Shulman sees an opportunity for high-growth stocks, especially in tech.

He clarifies: “It’s a buyer’s market but it’s very hit-or-miss” when it comes to investing in value versus growth stocks.

Shulman disagrees that interest rate increases could dampen tech stock prices because they’d need to be discounted more. He argues that tech stocks already have a high discount rate built into them by analysts because they are priced over a long period of time, and moving basis points don’t do much to affect the tech stocks.

“It’s the growth of these tech stocks that really drives their valuation, and the growth is still there,” Shulman added.

Speaking specifically about the fintech sector, Shulman believes that Square Inc. (NYSE: SQ) stands out. Square was up around 20% in April, and while it got hit hard in May, it is rebounding strongly.

Square is “a great growth story for a number of years…and I think it’s a good opportunity to buy right now,” added Shulman.

Bitcoin: “Volatile and it has a lot of problems”

Shulman expressed concerns about Bitcoin as an investment, adding that investors should “stay away” across the board.

He believes that “digital gold” is not an accurate moniker for Bitcoin. Gold has been used as a default currency for thousands of years. “It’s not a store of value,” he says of Bitcoin.

Shulman goes on to explain that the lowest volatility for Bitcoin historically “has never been below the highest level for gold.”

What’s more, the environmental impact of cryptocurrency mining is extreme; Bitcoin “is not ESG friendly,” Shulman said.

The offer of miners to change their protocol to become more environmentally friendly is concerning because in changing the protocol, miners could also decide to make the supply of Bitcoin unlimited. It is currently capped at 21 million tokens. Creating an unlimited supply of any cryptocurrency “can basically destroy the value overnight,” said Shulman.

If miners are able to change the protocols in one area, such as ESG, they could also change the protocols in other areas as well.

The propensity for Bitcoin to be involved in illegal activities is yet another reason to stay far away from the digital assets. Because of the extortion surrounding the Colonial Pipeline, which was shut down by hackers, and the subsequent ransom payoff in $5 million in Bitcoin, “the FBI is now looking into bitcoin and how they can better regulate this.”

Shulman goes on to warn: “it’s not a question of if but when they’re going to regulate.”