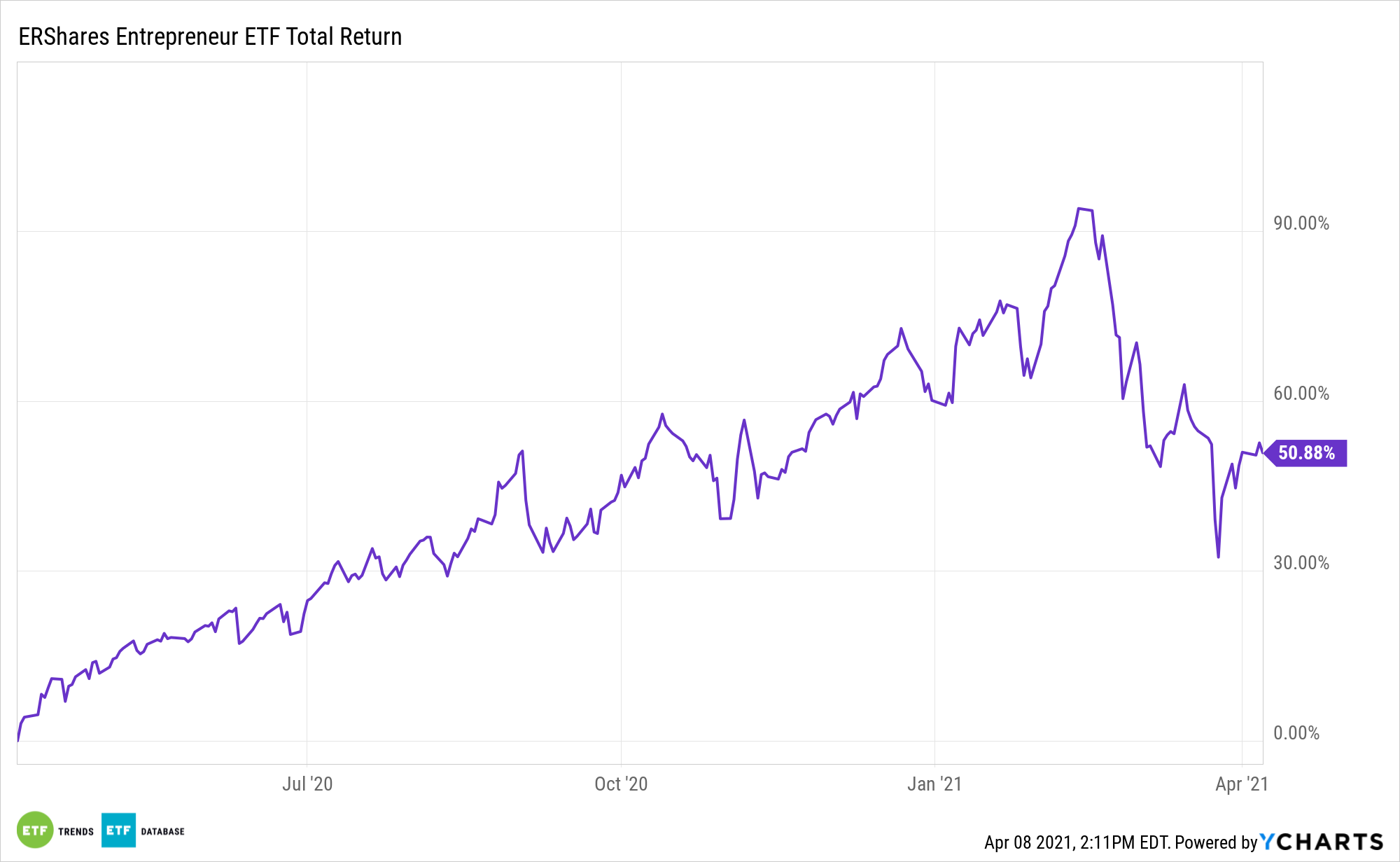

For once, value stocks are getting all the love, but that doesn’t mean growth fare should be glossed over. The ERShares Entrepreneurs ETF (ENTR) is an asset that can position investors for a growth rebound while maintaining some value exposure.

The fund is comprised of 30 U.S. companies with the highest market capitalizations and composite scores based on six criteria referred to as entrepreneurial standards.

The economy is currently in the nascent stages of the traditional recovery cycle, and investors should not let short-term noise distract them from growth opportunities. While there are the obvious plays in large tech stocks, investors shouldn’t overlook additional growth opportunities that often fly under the media’s radar. ENTR is an avenue for capitalizing on those opportunities.

Along with expectations of a rebound in profit growth this year and a recovery in economic activity, many market observers are arguing that the foundation for further stock market gains is in place.

Breaking Down the ‘ENTR’ Thesis

Growth stocks are often associated with high-quality, prosperous companies whose earnings are expected to continue increasing at an above-average rate relative to the market. Growth stocks generally have high price-to-earnings (P/E) ratios and high price-to-book ratios. Still, data suggest the growth/value premium isn’t overly elevated relative to historical norms.

Growth stocks may be seen as exorbitant and overvalued, causing some investors to favor value stocks, which are considered undervalued by the market. Value stocks tend to trade at a lower price relative to their fundamentals (including dividends, earnings, and sales). While they generally have solid fundamentals, value stocks may have lost popularity in the market and are considered bargain priced compared with their competitors.

See also: New Name, Same Gains for the High-Flying ENTR ETF

Many entrepreneurial firms are concentrated in the consumer discretionary and technology sectors, cementing ENTR’s growth feel.