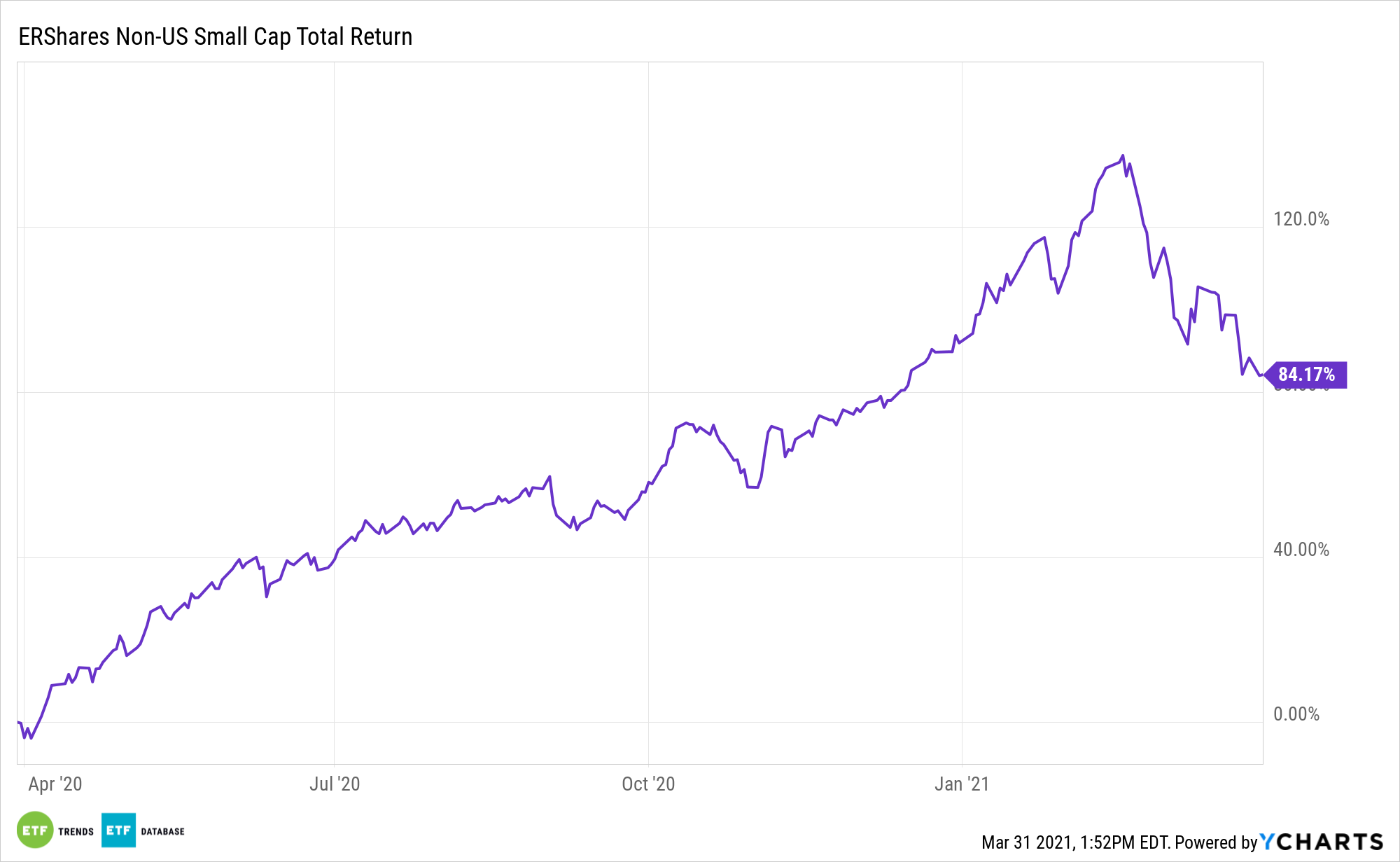

Recent lethargy in smaller stocks could spell opportunity some investors looking to assets like the ERShares NextGen Entrepreneurs ETF (ERSX).

ERSX selects the most entrepreneurial, primarily non-U.S. small cap companies that meet the thresholds embedded in its proprietary Entrepreneur Factor (EF). ERShares’ ETF delivers compelling performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics. Their geographic diversity enables them to harness global advantages through additional returns associated with currency fluctuations, strategic geographic allocations, comparative trade imbalances, and relative supply/demand strengths.

Amid rising Treasury yields, smaller stocks briefly fell out of favor, but the 2021 set-up for the asset class remains compelling.

“Small-cap stocks have had a remarkable run during the pandemic. As a result of this growth, many traders have been left to question whether or not this trend will continue in the months ahead,” notes Schaeffer’s Investment Research. “According to Todd Salamone, the technical picture of Russell 2000 and ETFs like the iShares Russell 2000 ETF (IWM) does suggest that the rising trend will likely continue.”

Smaller Can Be Better

The small cap category has underperformed its large cap peers, notably those mega cap tech companies that benefited in the post-coronavirus environment. However, a broader market rally has helped small caps outperform in 2021, and even outpace the tech-heavy Nasdaq. Even with recent weakness, small caps are topping large- and mid-caps this year.

“Speaking on small caps holistically, Salamone singled out the iShares Russell 2000 ETF (IWM) as offering diverse exposure to the small cap segment. The ETF is comprised of stocks throughout 11 different sectors, with the five biggest areas of exposure being a mix of growth and value segments like health care (the largest), consumer cyclicals, industrials, financial services, and technology (the smallest),” notes Schaeffer’s.

ERSX isn’t a traditional ETF. It blends domestic and international exposure, which is relevant at time when many markets are betting international smaller stocks will top U.S. equivalents. Non-U.S. equities are poised to take flight, and it’s possible that this asset class is in for a substantial period of out-performance.