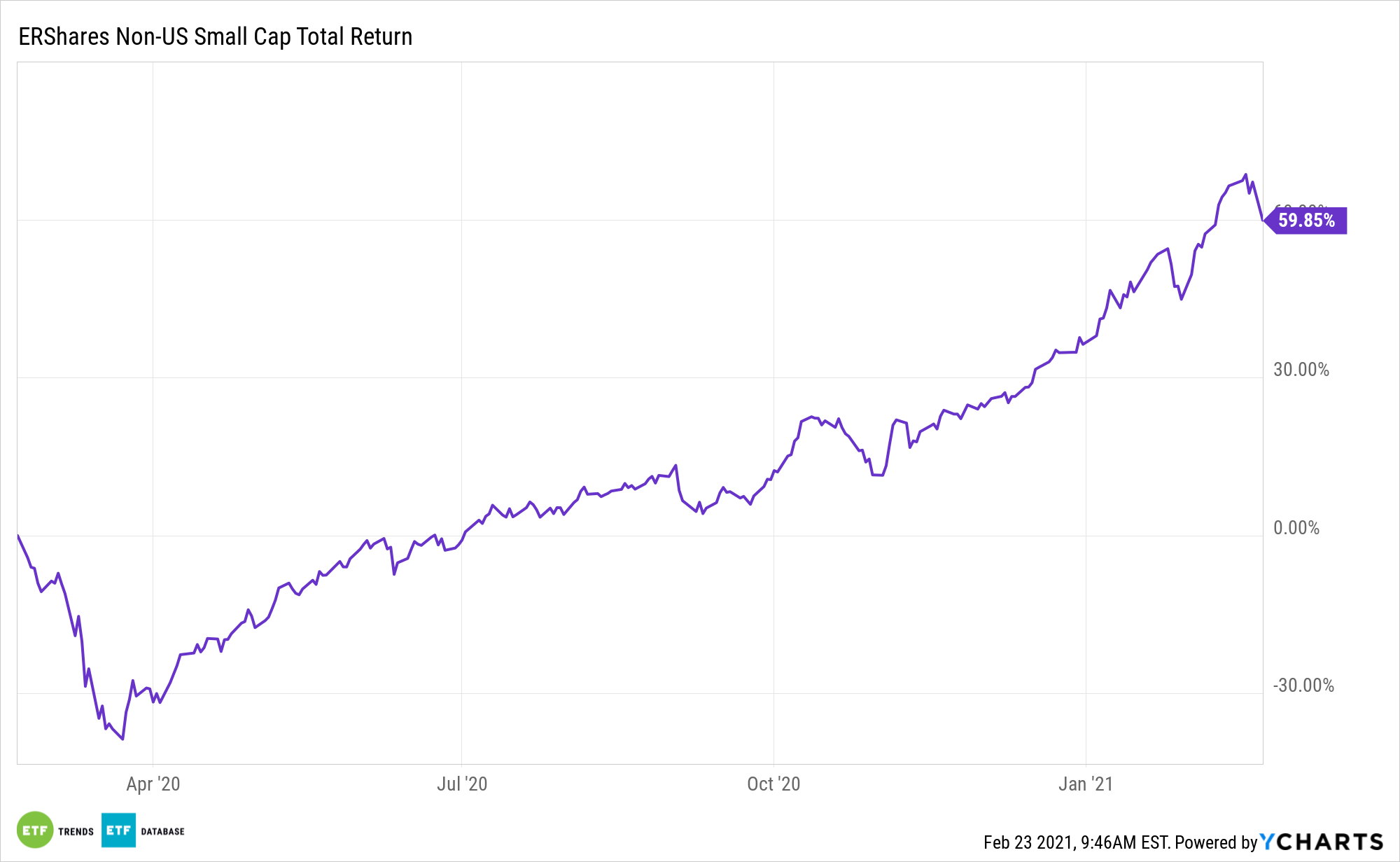

Small cap stocks lagged the broader market last week, but that doesn’t dent the case for exchange traded funds such as the ERShares NextGen Entrepreneurs ETF (ERSX).

ERSX selects the most entrepreneurial, primarily Non-US Small Cap companies, that meet the thresholds embedded in its proprietary Entrepreneur Factor (EF). ERShares’ ETF delivers compelling performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics. Their geographic diversity enables them to harness global advantages through additional returns associated with currency fluctuations, strategic geographic allocations, comparative trade imbalances, and relative supply/demand strengths.

Some market observers believe last week’s small cap lethargy could give way to upside opportunity.

“After a fierce run, smaller-capitalization stocks were hit by profit-taking this week, amidst a spike in Treasury yields. But gains still lie ahead for small caps, which are supported by strong earnings growth and reasonable valuations, analysts say,” reports Jacob Sonenshine for Barron’s.

A Good Time to Consider ERSX?

As investors look for ways to position their portfolios for the months ahead, small cap stock ETFs can help jumpstart a new market cycle.

Small cap companies typically show an advantage over large- and mid-cap stocks during the initial stages of an economic expansion phase. Small cap stock performances are more correlated with U.S. GDP, so their financial performance may be more aligned with the initial U.S. economic expansion period. There are other reasons to consider ERSX.

“The higher rate of return on the risk-free bond makes owning stocks less attractive. Another problem: While typically, higher yields are positive harbingers of growth for smaller companies, which are more economically sensitive than larger ones, that’s when yields are rising gradually,” according to Barron’s.

Increased fiscal spending could also support a shift toward cyclical companies, which are more tied to the broader economic recovery. These smaller companies, banks, manufacturers, and commodity producers typically do better as the economy exits a recession.

ERSX tracks a fundamental-selected index of global small cap ex-US equities weighted by market capitalization. The fund’s index is benchmarked against the FTSE All-World Ex-US Small Cap Index, a market-capitalization weighted index representing small cap stocks’ performance in developed and emerging markets excluding the United States. The index is derived from the FTSE Global Equity Index Series (GEIS), which covers 98% of the world’s investable market capitalization.