Investing in international small caps can be an exercise in finding hidden gems. The ERShares NextGen Entrepreneurs ETF (ERSX) makes that work easier.

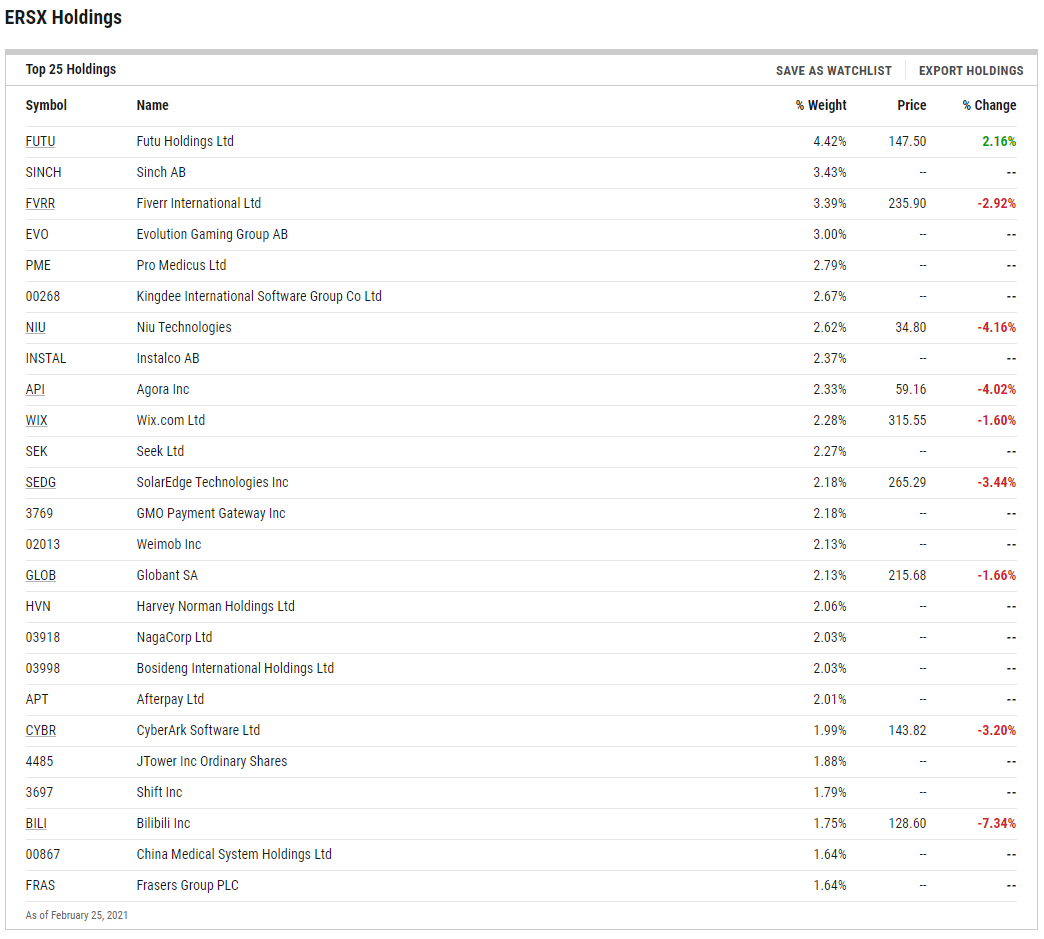

ERSX selects the most entrepreneurial, primarily Non-US Small Cap companies, that meet the thresholds embedded in its proprietary Entrepreneur Factor (EF). ERShares’ ETF delivers compelling performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics. Their geographic diversity enables them to harness global advantages through additional returns associated with currency fluctuations, strategic geographic allocations, comparative trade imbalances, and relative supply/demand strengths.

The ERShares ETF is useful for gaining exposure to an often overlooked asset class.

“Despite U.S. investors’ being very comfortable with international investing, small-cap companies (market cap of $300 million-$2 billion) outside the United States have generally flown under the radar. Yet upon closer review, they stand out for several attractive reasons,” reports Investment News. “For starters, of the more than 6,000 publicly traded global small-cap stocks, only about 2,000 are domiciled in the U.S., while two-thirds are based abroad. And a large proportion of those companies are in developed and emerging countries with established markets and liquidity. This represents an extremely large and deep pool of companies that many U.S. investment portfolios simply aren’t exposed to.”

The Right Way to Small Caps?

Small cap investors already know that looking at equities outside the large cap universe can yield substantial gains, but one area they may not have considered is looking abroad.

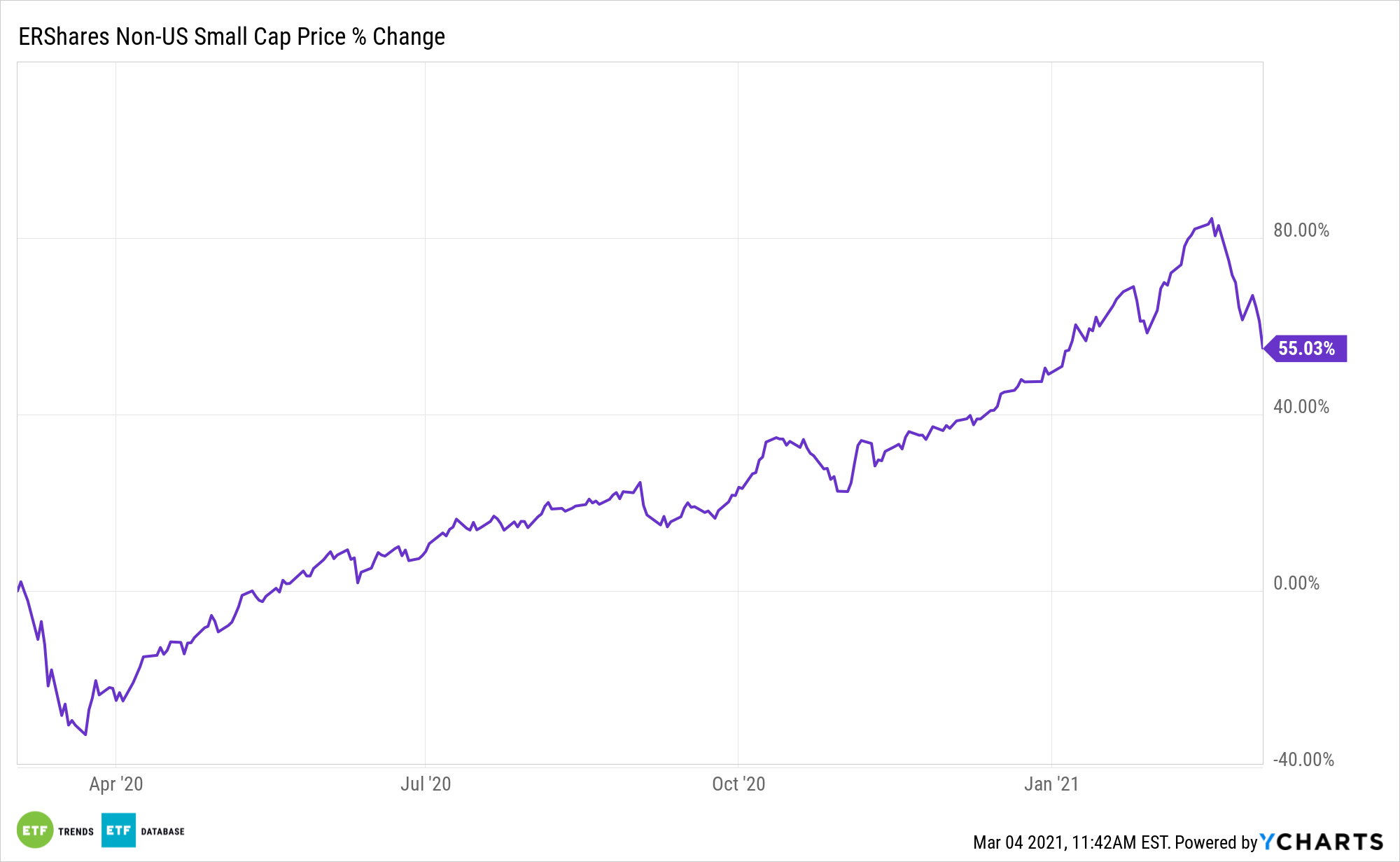

ERSX isn’t any old small cap ETF. It blends domestic and international exposure, which is relevant at time when many markets are betting international smaller stocks will top U.S. equivalents. Non-U.S. equities are poised to take flight, and it’s possible that this asset class is in for a substantial period of out-performance.

“International small caps, while generally considered riskier than the other parts of equity markets, also exhibit lower correlations to other asset classes, including to their U.S. counterparts. This may be viewed as both an attractive and particularly timely characteristic that can help U.S. investors prepare for the inevitable rise in interest rates and the potential resulting market turbulence, provided they’re willing to look beyond the U.S. and take advantage of the opportunities globally,” adds Investment News.