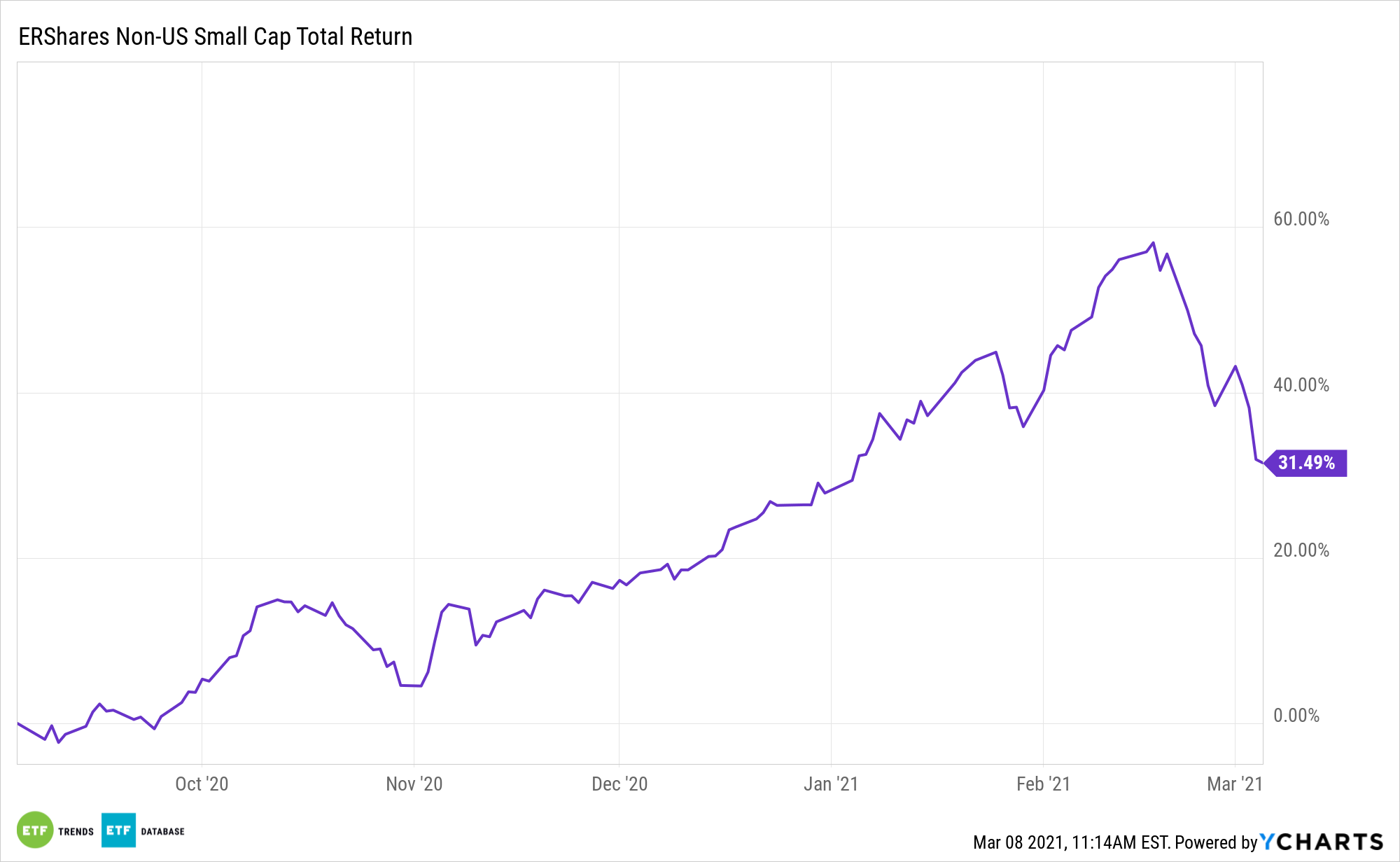

Data confirm investors are pouring cash into international equity funds, a scenario that bodes well for the ERShares NextGen Entrepreneurs ETF (ERSX).

ERSX selects the most entrepreneurial, primarily Non-US Small Cap companies, that meet the thresholds embedded in its proprietary Entrepreneur Factor (EF). ERShares’ ETF delivers compelling performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics. Their geographic diversity enables them to harness global advantages through additional returns associated with currency fluctuations, strategic geographic allocations, comparative trade imbalances, and relative supply/demand strengths.

The unique factor strategy offered by ERSX is ideally suited for investors looking to capitalize on both growth and value opportunities found with ex-U.S. smaller stocks.

“International exchange-traded funds are back in favor,” reports Ari Weinberg for the Wall Street Journal. “The turnaround has been building for months. Following the summer 2020 rally for U.S. stocks, interest in international developed- and emerging-markets stocks picked up in November and December and has surged through February. According to FactSet, international-stock ETFs (excluding “global” funds, which have U.S. exposure), have gathered $31 billion in net new assets in the first two months of this year, compared with $30 billion for all of 2020.”

With International Stocks, the Factors Matter

Getting international exposure is a great way to pull in uncorrelated market movements. But at a time when a pandemic has the whole world in its grasp, it becomes quite the challenge.

Many ex-U.S. markets are considered value destinations. ERSX offers quality/value tilts with several of its components holdings.

“The International Monetary Fund is projecting 5.5% global GDP growth in 2021, with growth in emerging markets and developing economies as a group projected at 6.3%, led by India (11.5%) and China (8.1%). Among developed economies, Spain (5.9%), France (5.5%) and the U.K. (4.5%) are expected to grow at a faster pace than the projected 4.3% for advanced economies as a whole. (The IMF estimates U.S. GDP growth at 5.1% in 2021.),” according to the Journal.

Small cap investors already know that looking at equities outside the large cap universe can yield substantial gains, but one area they may not have considered is looking abroad.

ERSX isn’t any old small cap ETF. It blends domestic and international exposure, which is relevant at time when many markets are betting international smaller stocks will top U.S. equivalents. Non-U.S. equities are poised to take flight, and it’s possible that this asset class is in for a substantial period of out-performance.