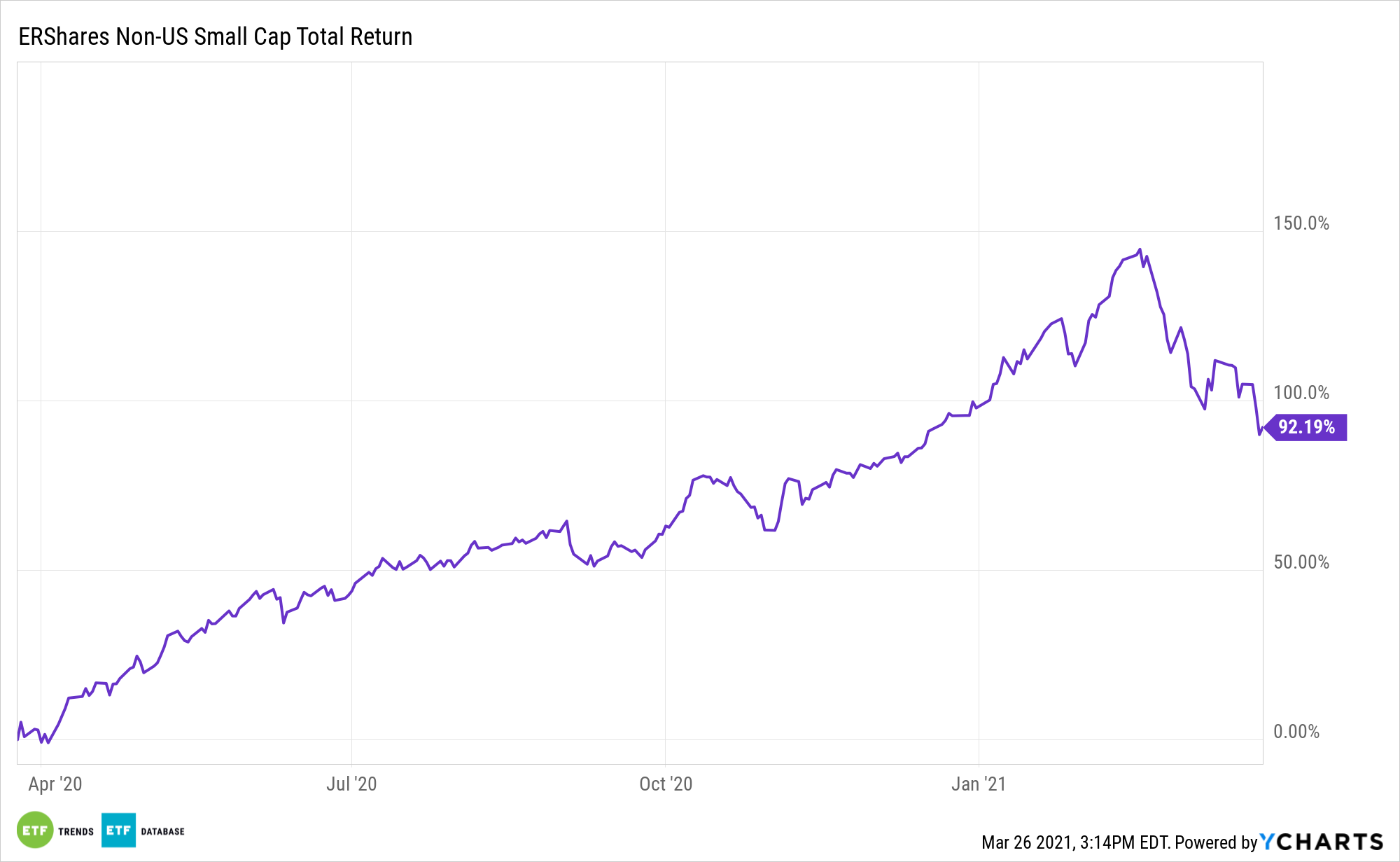

Recent market weakness is weighing on previously hot small cap equities, but that scenario could prove to be just the time to jump in. Consider the case of the ERShares NextGen Entrepreneurs ETF (ERSX).

ERSX selects the most entrepreneurial, primarily Non-U.S. Small Cap companies that meet the thresholds embedded in its proprietary Entrepreneur Factor (EF). ERShares’ ETF delivers compelling performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics. Their geographic diversity enables them to harness global advantages through additional returns associated with currency fluctuations, strategic geographic allocations, comparative trade imbalances, and relative supply/demand strengths.

“Small-capitalization stocks had been on an impressive run since September, when investors started moving into more economically-sensitive assets on hopes for an end to the pandemic and the reopening of the U.S. economy—plus trillions of dollars in fiscal stimulus,” reports Jacob Sonenshine for Barron’s. “Economic downturns are a bigger threat to the stability of smaller firms, since they don’t have the same access to capital that larger companies enjoy. And with many small-cap companies focused on the U.S. market, their earnings also tend to be more sensitive to changes in the domestic economic landscape.”

Getting Down to Business

Small caps capture more upside when markets are trending higher, yet they can also get hit harder during a downtrend, which makes this trade the riskiest of the bunch.

Yet there are good reasons to go with this segment, and beyond traditional cap-weighted strategies at that.

“In recent days, investors have been repositioning away from cyclical stocks after the group’s long winning streak, and small-caps have been no exception. While it is anybody’s guess when this pullback will end, small-cap stocks are looking increasingly attractive to some analysts as a result,” adds Barron’s.