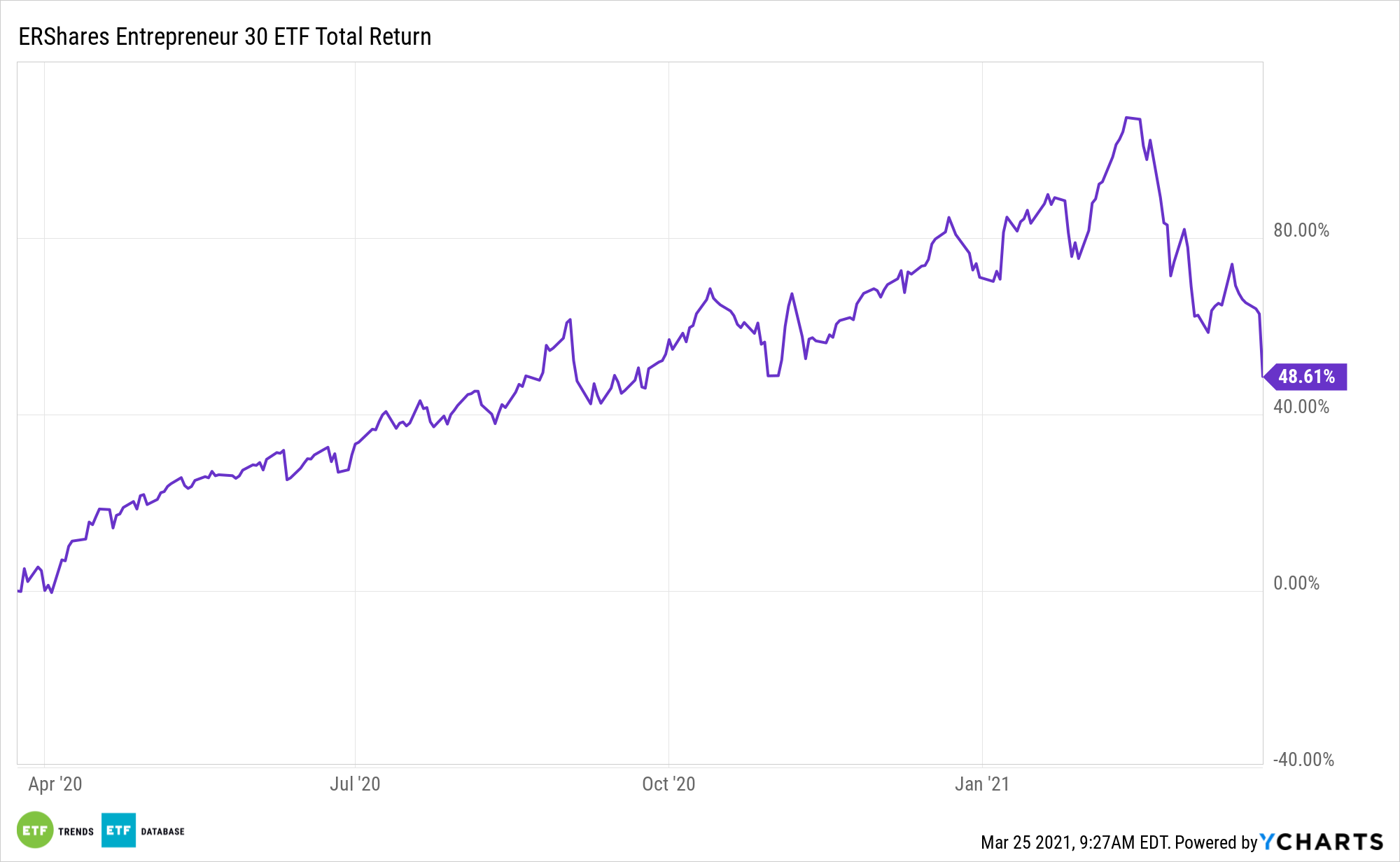

Amid raucous market action, the bulk of which is being caused by rising Treasury yields, the ERShares Entrepreneurs ETF (ENTR) is becoming more attractive on the basis of price, while its underlying fundamentals remain sound.

ENTR tries to reflect the performance of the Entrepreneur 30 Index, which is comprised of 30 U.S. companies with the highest market capitalizations and composite scores based on six criteria referred to as entrepreneurial standards. ENTR primarily invests in US Large Cap companies that meet the thresholds embedded in their proprietary Entrepreneur Factor (EF).

See also: The Entrepreneur Factor: Distinguishing Characteristics of Dynamic, Disruptive Investing

There has been a significant shift in how companies conduct business over the last year, with many corporations transitioning their employees to the home as more stringent regulations become commonplace. With this shift comes a need for innovation, with companies like Ring, Crowdstrike, Tesla, and Fiverr embracing an entrepreneurial mindset. Investors looking to get in on the action can look to the issuer ERShares.

ERShares selects companies from all over the globe and across capitalization levels to create an eclectic and well-balanced mix in its funds.

ENTR Standing Out from the Crowd

ENTR is comprised of 30 U.S. companies with the highest market capitalizations and composite scores based on six criteria referred to as entrepreneurial standards. The fund has exhibited excess return potential by taking into consideration factors that account for alpha generation, such as growth, size, momentum, and value, among others.

“Investors, or academics, that presume we are simply a ‘growth play’ or ‘momentum play’ are often surprised to discover that our Entrepreneur Factor is not only significant in explaining historical returns, but over the past 12 years has been, by far, the most significant factor,” according to the issuer. “The selection effect (Entrepreneur Factor) actually compensates for all the other factors, which in aggregate are actually negative during the time period. This is why the selection effect is even higher than the excess return itself.”