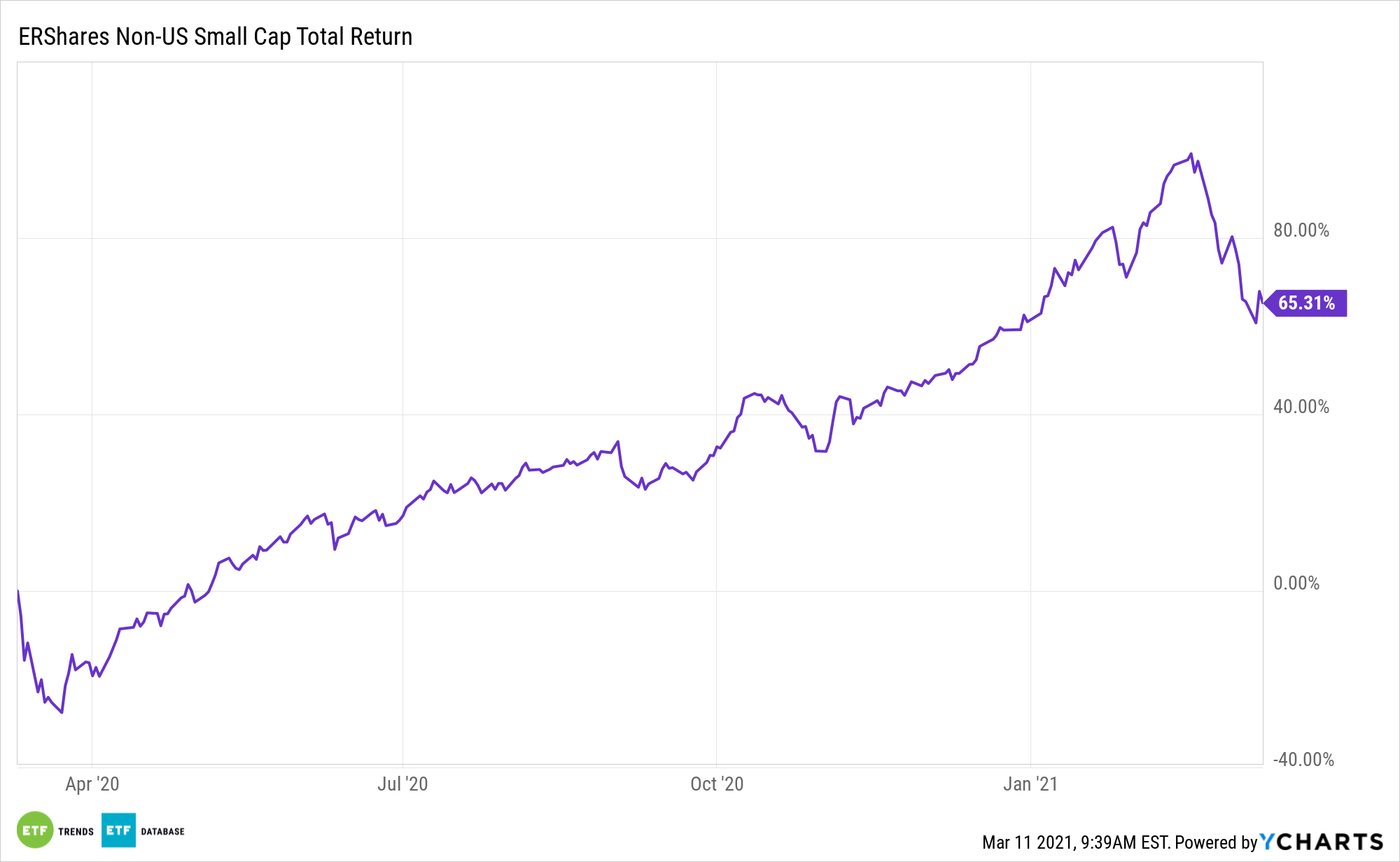

Even with some recent weakness in equities, small caps and foreign stocks remain appealing. That script underscores the continued allure of the ERShares NextGen Entrepreneurs ETF (ERSX).

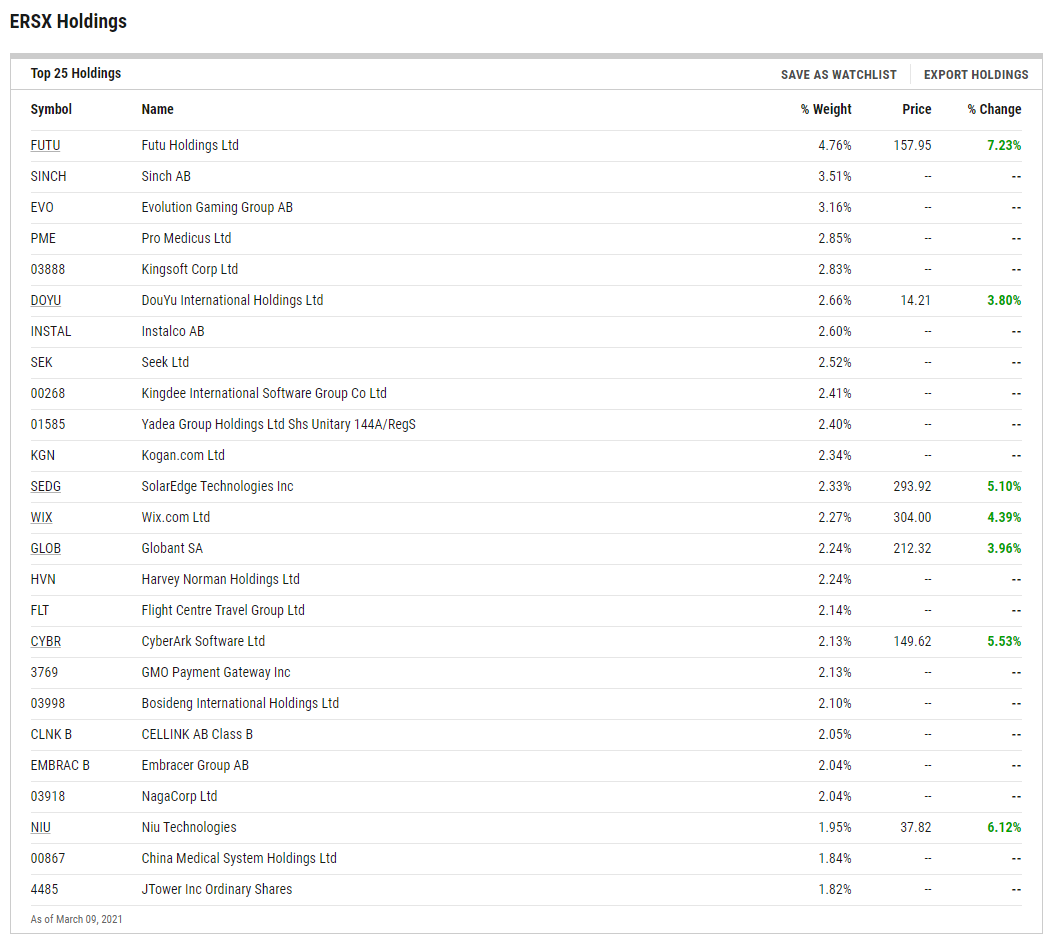

ERSX selects the most entrepreneurial, primarily Non-US Small Cap companies, that meet the thresholds embedded in its proprietary Entrepreneur Factor (EF). ERShares’ ETF delivers compelling performance across a variety of investment strategies without disrupting investors’ underlying risk profile metrics. Their geographic diversity enables them to harness global advantages through additional returns associated with currency fluctuations, strategic geographic allocations, comparative trade imbalances, and relative supply/demand strengths.

“The year-to-date return for small-caps through the end of February was a remarkable 25 percentage points greater than that of large-caps (as measured by the 20% of stocks with the smallest market caps vs. the comparative quintile of the largest),” reports Mark Hulbert for the Wall Street Journal. “While it isn’t unexpected for small-cap portfolios to beat large-caps over time—a long-term tendency that Wall Street analysts refer to as the ‘size effect’—what is unusual is the magnitude of the outperformance. It has averaged just 0.9 percentage point over all two-month periods since 1926, according to data from Dartmouth professor Ken French.”

The unique factor strategy offered by ERSX is ideally suited for investors looking to capitalize on both growth and value opportunities found with ex-U.S. smaller stocks.

ERSX Leadership

Why focus on entrepreneurial companies? Founder-run entrepreneurial companies have shaped the economy by investing in its people and innovation leading to exceptional growth. Having the right Founder-CEO can make an important difference. The differential between the time period with a Founder-CEO and without is approximately 7% in excess return.

See also: The Small Cap ERSX ETF: Finding Hidden Gems Abroad

“Indeed, according to several researchers, small-caps’ recent strength may actually be something else in disguise—that is, it may have to do with factors other than just size, such as the battle between growth and value stocks,” according to the Journal.

Entrepreneurial companies were better able to shift gears to adapt to the new market environment, swiftly pivoting their strategies to protect people from the pandemic and support people adapting to new living routines. They also led the way, irrespective of market cap and geography. Many global companies also pivoted well during uncertain markets and outperformed in bull markets.