Growth stocks may be out of favor, but that may allow investors to snag favorable pricing on industries with excellent growth prospects.

One of those industries is genomics, which is forecast to grow in significant fashion over the next decade. Investors can get in on the action without direct commitment with the ERShares Entrepreneurs ETF (ENTR).

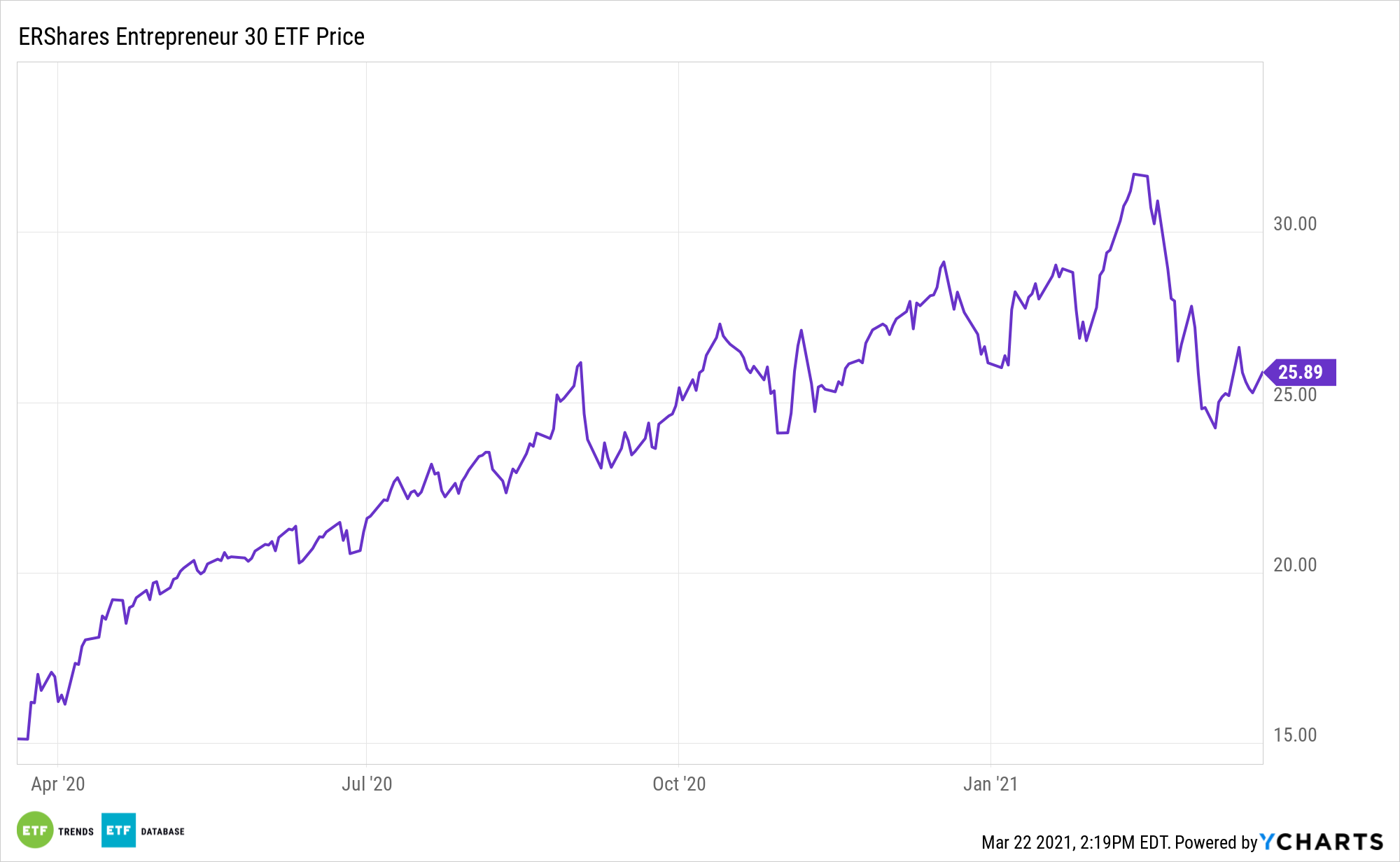

ENTR tries to reflect the performance of the Entrepreneur 30 Index, which is comprised of 30 U.S. companies with the highest market capitalizations and composite scores based on six criteria referred to as entrepreneurial standards. ENTR primarily invests in US Large Cap companies that meet the thresholds embedded in their proprietary Entrepreneur Factor (EF).

Biotech and genomics companies such as Crispr, Intellia, Twist Biosciences, Veracyte, and Editas have more than quadrupled year-to-date.

Genomics’ Long Runway for Growth

Genomics companies try to better understand how biological information is collected, processed, and applied by reducing guesswork and enhancing precision. The industry is a booming market with epic potential for investors.

Rising government funds for research on genomics have driven the growth of the single-cell genomics market. The funding focuses on efforts to resolve the complexity of the human genome and the genomic basis of human health and disease. It also ensures that genomics is used safely to enhance patient care and benefit society through government, public, and private institutions.

According to “Genomics Market – Growth, Trends, and Forecasts (2020-2025),” exponential growth in the space is expected within the next five years.

“The Genomics market studied was anticipated to grow with a CAGR of 9.3%, during the forecast period,” a press release on the report noted. “The major factors attributing to the growth of the genomics market are growing government support and increased number of genomics studies, declining sequencing cost, increased genomics applications. The genomics market is geared to exponential growth as a result of the essential genetic developments and also because of its applications in numerous areas of study, such as intragenomic phenomena like epistasis, heterosis, pleiotropy, and other associations within the genome between alleles and loci. And there are few more factors which are playing crucial roles in taking the genomics market to the next level, among them one is on-bioengineering and synthetic biology applications which are expected to further propel the growth of the genomics market.”