The global economy has evolved considerably in the past century. Economic growth and productivity have witnessed a complete paradigm shift. Productivity fueled by industrial manufacturing, advancements in transportation, and innovations in oil drilling enabled developing nations to prosper and generate riches in steel, automobiles, airlines, and manufacturing facilities. Industrial Sectors built global titans such as Henry Ford, John D. Rockefeller, Cornelius Vanderbilt, and Andrew Carnegie. Much has changed since then. Today’s wealth creators no longer reside in Energy, Manufacturing, and other Industrial Sectors. Nowadays exceptional growth opportunities reside in Technology and Health Care and include Entrepreneurs such as Jack Dorsey, Jeff Bezos, Elon Musk, and recently departed Steve Jobs. And unlike the robber barons from past eras, they do not extract wealth from competitors through unethical practices or the breakup of unions. The new breed of Entrepreneurs creates wealth and jobs through capital markets that allow all stakeholders to share in the rewards as they grow. Moreover, today’s entrepreneurs lead by example and often have a loyal, sometimes fanatical fan base unlike tycoons from bygone eras who were universally loathed and lampooned.

The recent experience during the 2020 pandemic makes clear how much our global economy depends on nimble entrepreneurs who can pivot quickly and create wealth and jobs during uncertain times. Much of the wealth and job creation has occurred within the Health and Technology sector, and as we show below, has a heavy concentration among publicly traded entrepreneurial companies. Moreover, the growth in Health and Technology firms have strong ESG ramifications: virtually no environmental impact, provide major benefits to social growth and infrastructure development and are driven primarily by entrepreneurial leaders with strong governance traits. Given the well documented pattern of growth in the most recent periods, all signals suggest this trend will only strengthen in future years.

Clear Pattern in S&P 500 Composition–Technology and Health Care Sectors Gain Dominance

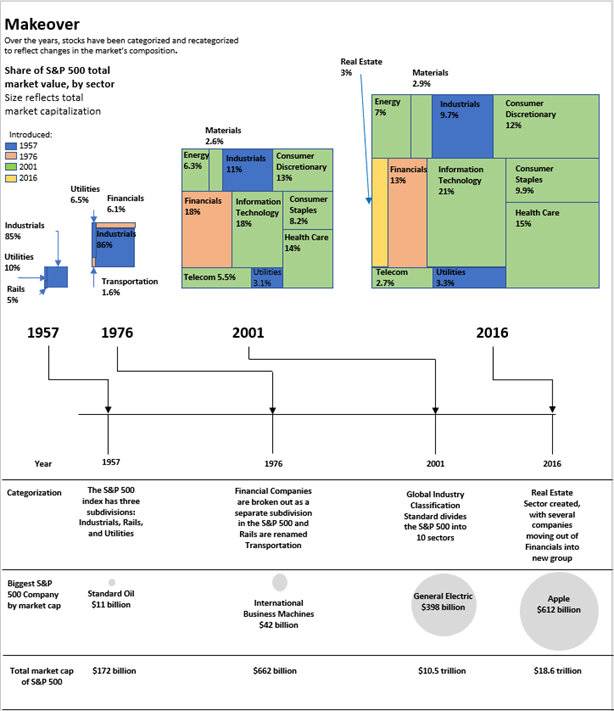

Early evidence of the Standard and Poor’s 500 Index (S&P 500) illustrates how even 60 years ago, Industrials comprised 85% of member constituents with Utilities and Rails holding 10% and 5% respectively (see exhibit below). Records from 1957 show how the S&P 500 total market cap was $172 billion with Standard Oil securing the top spot with a valuation of $11B. By 1976 the composition changed modestly with Industrials commanding (86%) of the total allocation, Financials (6%), Utilities (7%) and Transportation (2%). IBM was the heaviest market cap of $42B. In 2001 the S&P implemented a significant, more detailed classification makeover providing greater clarity in sector composition. General Electric ($398B) was the dominant firm in 2001 and the two main sectors were represented by Financials (18%) and Information Technology (18%) followed by Health Care (14%), Consumer Discretionary (13%), and Industrials (11%). By 2016, Apple ($600B) was the largest market cap company in existence, corresponding with Information Technology (21%) being the most significant sector. Other dominant sectors include Health Care (15%) and Financials (13%). In the approximately 60-year time of reporting, the S&P 500 grew total market cap from $172 billion to $18.6 trillion. Along with the substantial growth, however, the market composition changed considerably away from Industrials to Information Technology and Health Care.

In 2020, the S&P 500 composition shows Information Technology (27%) as the clear top sector with Apple ($2.1 trillion) as its most significant market capitalized firm. Health Care (14%) is the second most

significant sector followed by Communication Services (11%), Consumer Discretionary (11%), Financials (10%), and Industrials (9%). Notably, the concentration of the top 5 market cap weight stocks Apple ($2.1 trillion), Microsoft ($1.6 trillion), Amazon ($1.6 trillion), Alphabet ($1.1 trillion) and Facebook ($660 B) approximates half the total market cap of all 500 S&P constituents from just 19 years earlier.

Pandemic Accelerates Shift to Entrepreneurial IT and Health Care Companies by Order of Magnitude

Even prior to the COVID-19 health crisis in 2020, the trend toward Technology and Health Care was well established. However, the pandemic rapidly accelerated the timetable by a sizeable shift in magnitude. While the manufacturing, transportation, energy, and consumer discretionary sectors were essentially shut down, the Health Care and IT sectors, largely driven by entrepreneurial companies, immediately embraced the challenge to develop effective vaccines and immediate solutions to keep people safe and our economy running.

Work-from-home and virtual meetings, while developing in popularity prior to the health crisis, quickly became mandatory for economic survival. The health crisis fundamentally changed, overnight, long-standing habits and personal behaviors. In the absence of technological advances, individuals would not have been able to telecommute for work, enact virtual visits for business/personal conversations, utilize online shopping, complete ease of delivery or virtually visit with their health providers. Changes in behavior happened quickly, by necessity, and the health crisis expedited many work and personal changes that would have normally taken much longer to implement. It was Entrepreneurial Information Technology companies that primarily met consumer and business needs. Companies such as Zoom provide video technology for workers and students and other companies such as Amazon provide online shopping and ease of delivery. Netflix and Facebook provide entertainment and communication platforms to help fill additional personal needs. Notably, these companies represent only a handful of the many, entrepreneurial companies that quickly pivoted to meet market needs during a critical time period.

Importantly, Entrepreneurial Health Care companies like Moderna, Teladoc and Regeneron without hesitation promptly pivoted to build a new vaccine or breathing apparatus for victims desperately seeking a medical miracle. Other entrepreneurial companies enabled patients to virtually visit medical professionals in a timely, safe, efficient manner, without exposing parties to harmful disease. These entrepreneurs were the first to capitalize on an opportunity and propose workable, innovative solutions for the public. Not surprisingly, major Health Care companies were not actively visible in the early stages of the crisis. Traditionally, these companies miss timely opportunities and inaction due to sluggish corporate cultures steeped in corporate bureaucracy. Unprecedented circumstances disrupted conventional timetables. Health Care professionals and political leaders, who traditionally do not engage in active partnerships, fast-tracked processes and approval processes that were unthinkable until recently. Experimental drug tests have been discussed in real time, along with news updates concerning health and potential danger hot spots. All this new information can be attributed to innovative, entrepreneurial solutions.

Though the value of life, whether lost or saved, can be easily measured in the short-term with simple head counts, the true costs of the health crisis may require years to correctly assess. Fundamental changes in the way in which people live, work, commute and travel are likely. Further, individuals will likely change patterns in dining or entertainment venues (e.g., sporting events, theatre, etc.). Each of these changes have far-reaching ramifications on the quality and impact of life and influence the environment, social infrastructure and governance of our corporations and political establishments.

Health Care and Information Technology companies will continue to emerge as key contributors going forward. Health Care, in particular, will gain in prominence as life expectancy is expected to continue to climb.

Surging Life Expectancy Boosts Health Care Sector

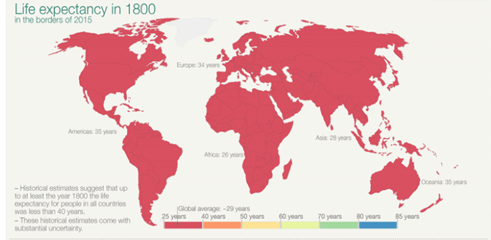

Arguably the strongest contribution any sector has made to mankind is within the Health Care sector. Although humans have inhabited the planet for well past 100,000 years, it has only been in the past 100 years that life expectancy has changed appreciably. Prior to the 1800s, regardless of location, human life expectancy was less than 40 years (see graph below). This longevity was true regardless of birth origin or economic prosperity.

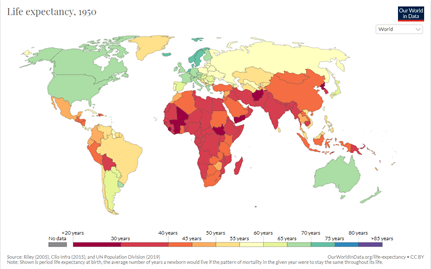

In the twentieth century, the gap began to widen considerably between developed and developing nations as modern health care emerged. Differences were substantial, corresponding with geographic location, and medical advances (see graph below). Those in developed nations, such as the United States, could expect a life of 70+ years whereas those in an emerging market would perish in approximately 1/2 that time. In some nations (primarily within Africa) average life expectancy fell below 30 years.

In recent years, the gap between developed and developing nations has narrowed with developing nations experiencing the strongest growth (see graph below). People residing in developed nations generally anticipate an average life above 80 years whereas those in developing nations rests closer to 65. Notably, life expectancy has virtually doubled in the past 200 years for all peoples with residents in developed countries receiving benefit in the 1800’s and developing nations seeing significant changes in the 1900s. Given the steady state in this important statistic for 99.95% of human existence, the recent medical advancements and pharmaceutical developments that have led to the doubling of life expectancy, in such a relatively short time period, represent a remarkable transformation.

Through these medical breakthroughs, individuals have been impacted in an unprecedented, positive manner. Humans now enjoy a longer, healthier presence with continuing enrichments delivered by the Health Care community on an ongoing basis, and it is this area that provides the most promise on a continuing basis. New research and innovations tracking early evidence of organ disease and malfunction, along with advancements in genomics (DNA), wearable technologies and artificial intelligence all will help extend the quality of life for humans. Many of the scientists behind these innovations are Entrepreneurs who drive much of the growth and through their companies we can monitor to gauge their representative journey through the Capital Markets. Although it is IT companies that dominate S&P 500 constituents, as we move to smaller capitalization area, it is Health Care companies that dominate, indicating the sector’s great potential for exponential growth in the near future.