ERShares

Funds

For Institutional Investors

Unique investment strategies and above average performance

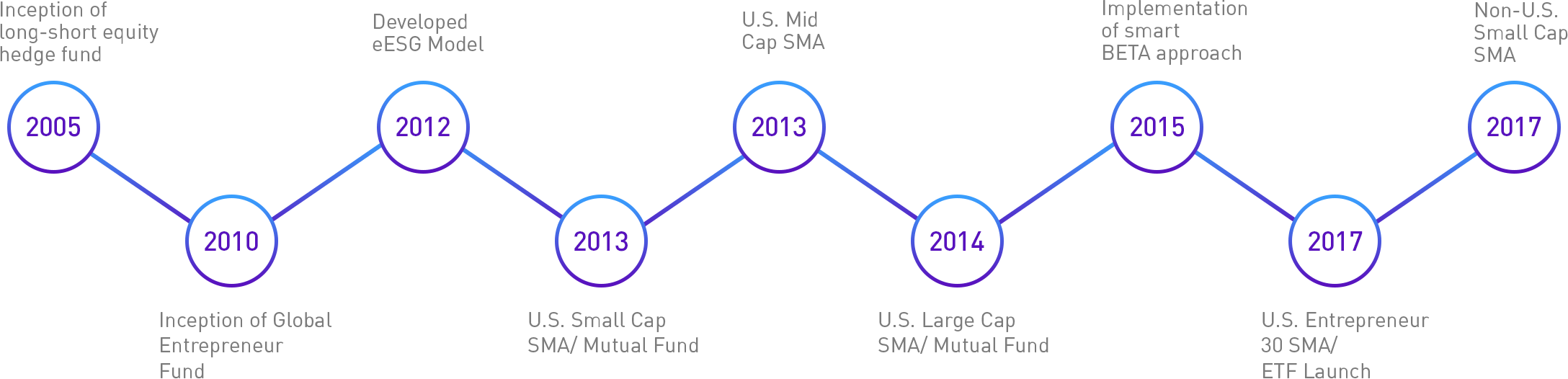

Since 2005, ultra-high-net-worth and institutional investors have relied on ERShares to provide unique investment strategies and above-average performance. Driven by a strong belief that publicly traded Entrepreneurial companies outperform their peers, we offer strategies to help institutional clients pursue higher expected returns. Our approach incorporates a comprehensive academically-oriented methodology that enables us to create practical and successful investment strategies that extend to the global investment market.

An Entrepreneur Strategy for Every Morningstar Classification

Our institutional clients including pension plans, endowments, consultants, corporations, and other institutions target varying sections within the traditional Morningstar classifications. At ERShares, we believe we have added an entirely new dimension, management characteristics or Entrepreneur, to the classic value-growth, and small-large capitalization to the Morningstar box. The Entrepreneur dimension enables savvy investors to select the most desirable equities within their preferred Morningstar classification. Consequently, our Entrepreneur approach allows investors to potentially generate stronger returns with the same expected risk-return characteristics.

We employ our Entrepreneur strategy across a variety of market capitalizations and geographical regions. This means that even though our method tends to emphasize growth-oriented organizations, we can successfully apply it to both growth and values stocks with small, mid, or large-cap capitalization around the world. This is demonstrated by our entrepreneurial ETF and entrepreneurial mutual funds’ performance. Our research shows that our Entrepreneur strategy generates excess risk-adjusted returns over time and provides the largest explanatory factor of those excess returns.

The ERShares methodology is a proprietary trade secret, but the basic message is clear: we select the most entrepreneurial, strong growth, global companies and puts it to market in one easy-to-invest-in fund. Many investment companies claim disruptive technology, but only ERShares ensures that the right technology is matched with the right leaders. We believe that without the best entrepreneurial minds, technology alone won’t get very far.

The ERShares Legacy

Click to view timeline fullscreen

Contact Us

Fill out the form below to connect with us.