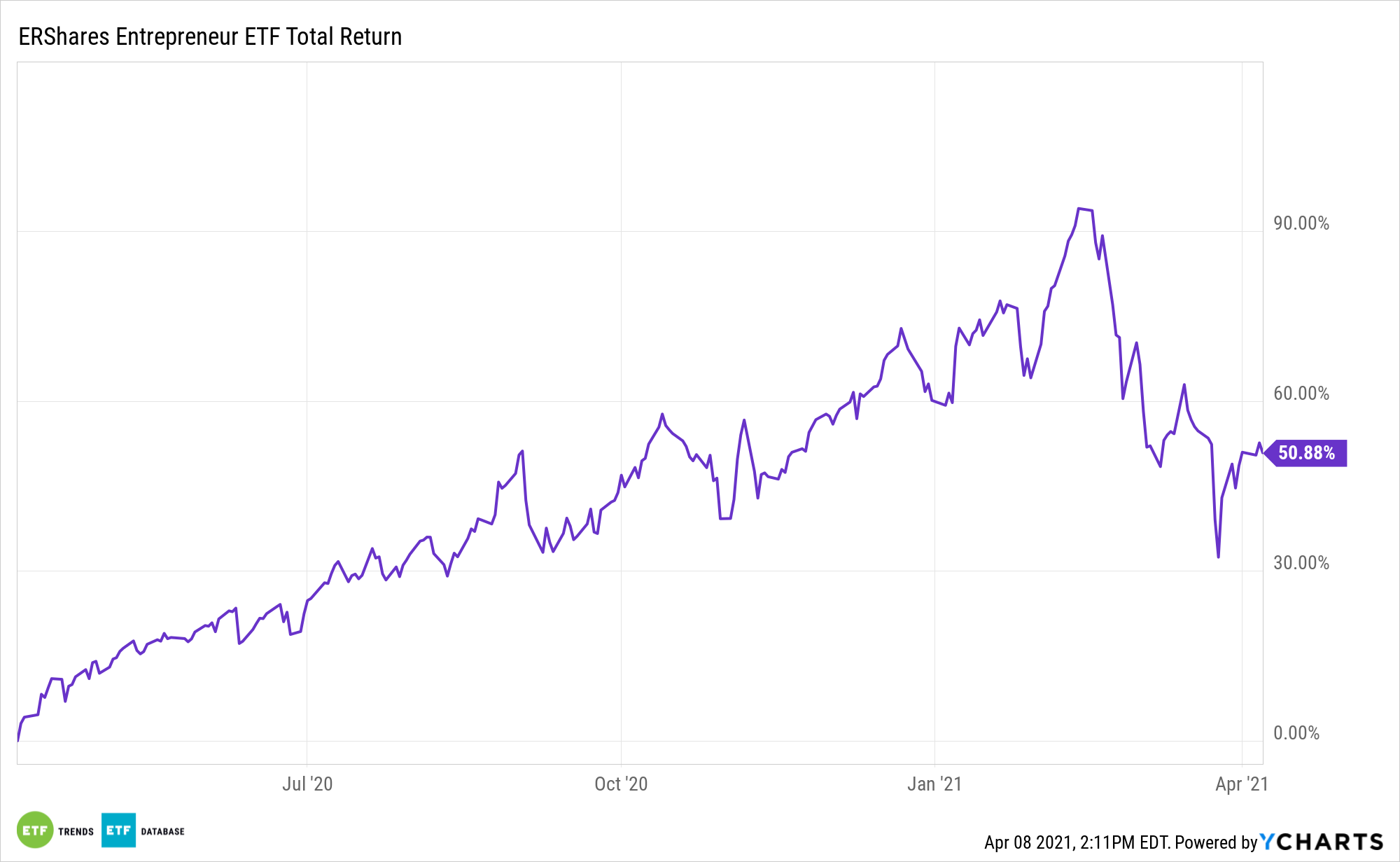

Growth stocks are suddenly on sale, and with that scenario comes opportunity for investors to embrace entrepreneurial companies at discounts. There’s an ETF for that: the ERShares Entrepreneurs ETF (ENTR).

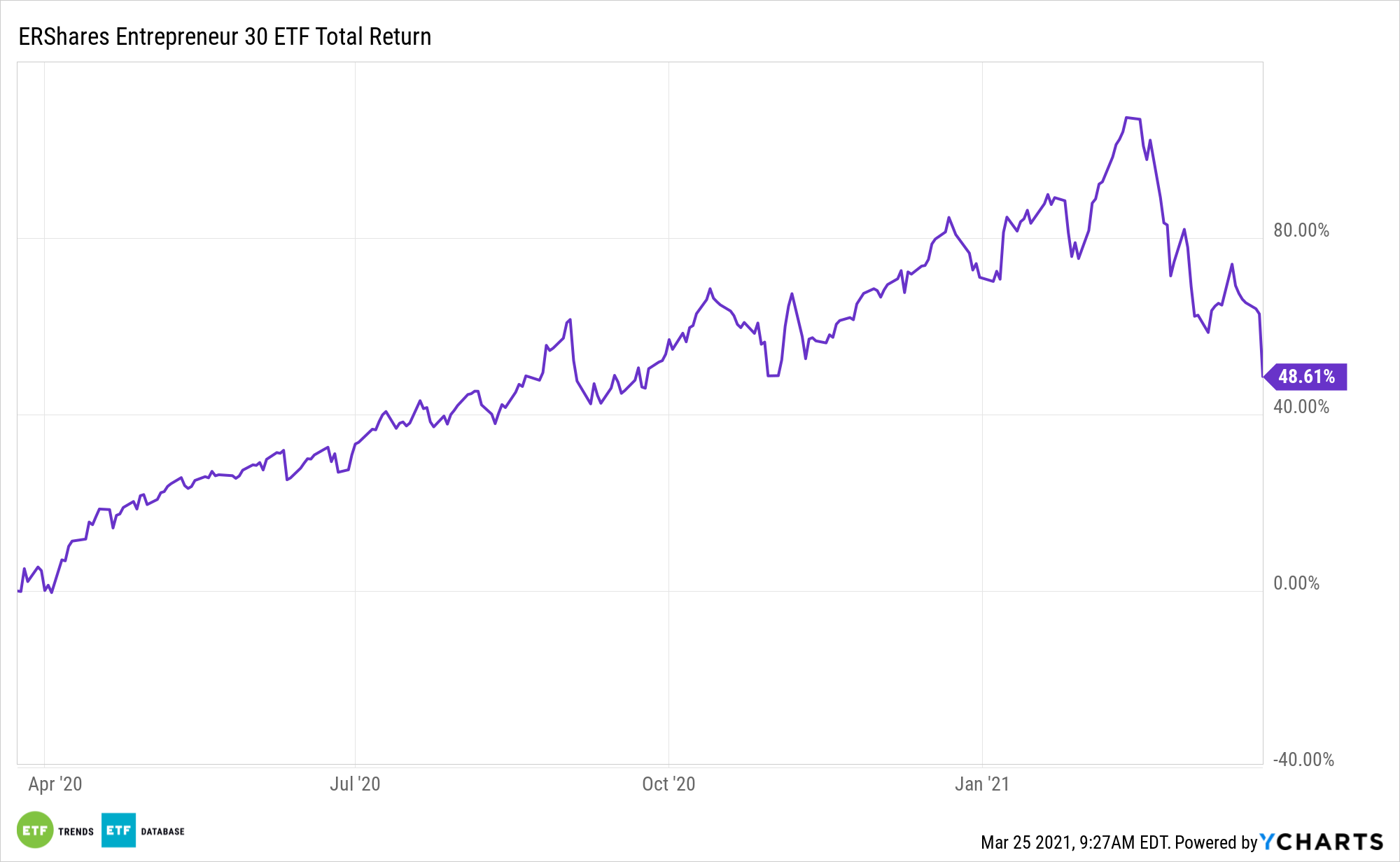

ENTR tries to reflect the performance of the Entrepreneur 30 Index, which is comprised of 30 U.S. companies with the highest market capitalizations and composite scores based on six criteria referred to as entrepreneurial standards. ENTR primarily invests in US Large Cap companies that meet the thresholds embedded in their proprietary Entrepreneur Factor (EF).

See also: Add ‘Entrepreneurship’ to the Investment Factor Debate

History proves there are compelling reasons to invest in fashion similar to ENTR, or better yet, own the fund itself.

ENTR’s Recipe for Success

Many entrepreneurial firms are concentrated in the consumer discretionary and technology sectors, cementing ENTR’s growth feel.

There has been a significant shift in how companies conduct business over the last year, with many corporations transitioning their employees to the home as more stringent regulations become commonplace. With this shift comes a need for innovation, with companies like Ring, Crowdstrike, Tesla, and Fiverr embracing an entrepreneurial mindset. Investors looking to get in on the action can look to ERShares.