XOVR applies a venture-capital lens to public innovators—anchored by our

proprietary ER30TR Index research—and complements them with a measured,

policy-capped sleeve of select private companies, all within a single,

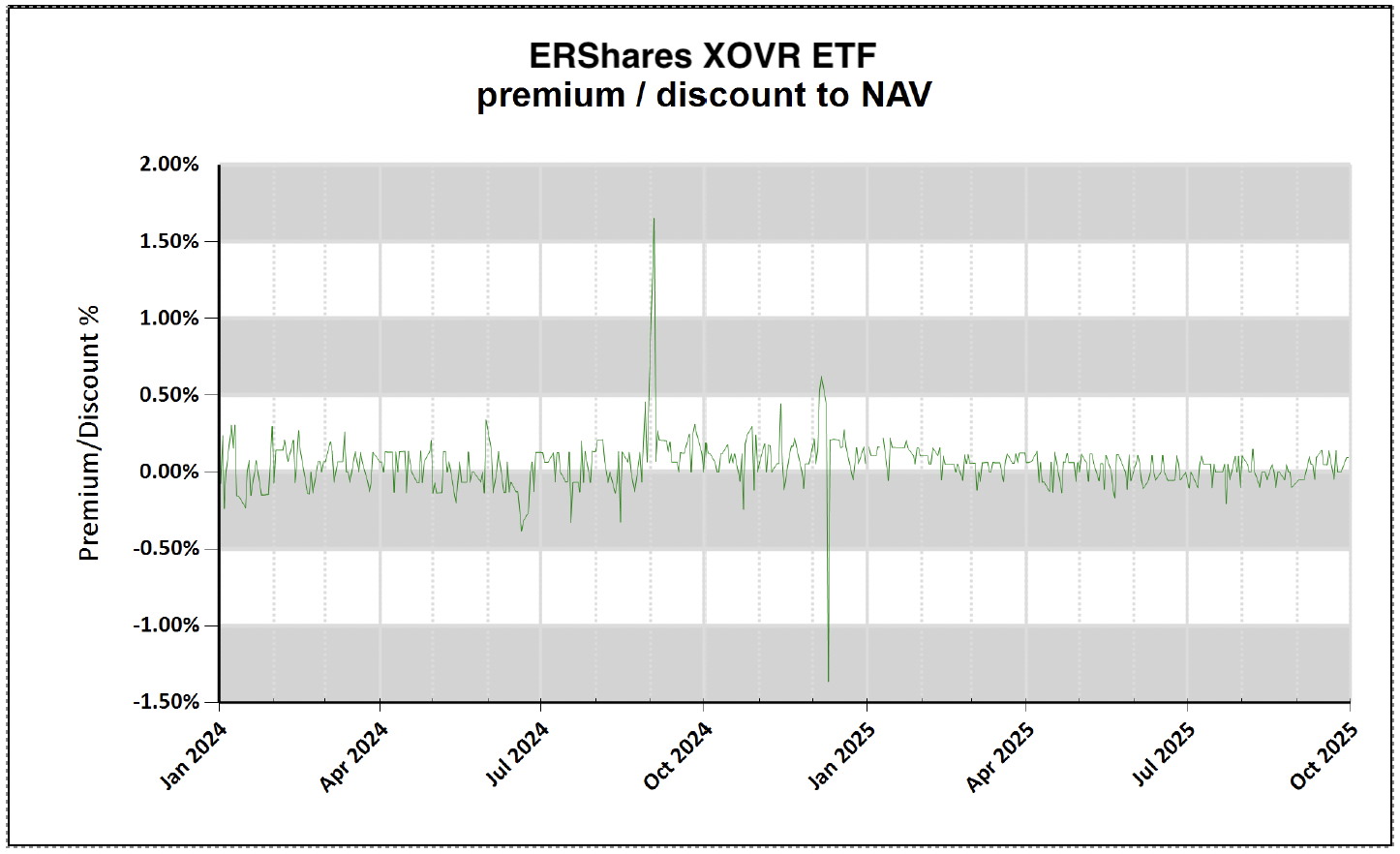

daily-liquidity ETF. The design provides institutional-style exposure to

the pre-IPO economy without closed-end premiums, lockups, or interval-fund

gates. Holdings are dynamic and may change.

Democratizing Retail Access To Private-Equity Exposure

Access historically limited to accredited investors, delivered inside an ETF with daily liquidity and standard brokerage access.

Single-Ticker Simplicity

Public innovators + measured private exposure with standard brokerage access and daily transparency.

Proprietary VC-Style Research You Can Trade

The Entrepreneur Factor® and ER30TR Index power a rules-driven public core paired with a selective private sleeve carried in daily NAV.

Risk Controls By Design

Private sleeve sized by policy caps; diversified across entrepreneur-led leaders.

Pre-IPO Exposure, ETF Liquidity

Institutional-style access without closed-end premiums, lockups, or interval-fund gates; shares trade daily.

Transparency & Governance

Daily holdings disclosure; valuation under a board-approved policy; standard ETF custody and oversight.

Examples of private-company exposure have included SpaceX and Anduril; we also held Klarna while private and continued to hold it after its 2025 public listing—making XOVR, to our knowledge, the first U.S.-listed ETF to disclose a private holding that subsequently became a public holding within the same ETF. Holdings change; see current holdings.